In a light week of economic reporting, the major news encompassed the latest GDP reading falling. Unfortunately, fourth-quarter GDP fell to the lowest level since spring of 2020. However, analysts interpret this is a short-term problem.

Over the past week, the major economic data caused little reaction. Daily movements in mortgage markets offset one another. As a result, rates ended the week little changed.

GDP Reading Fell in Fourth Quarter

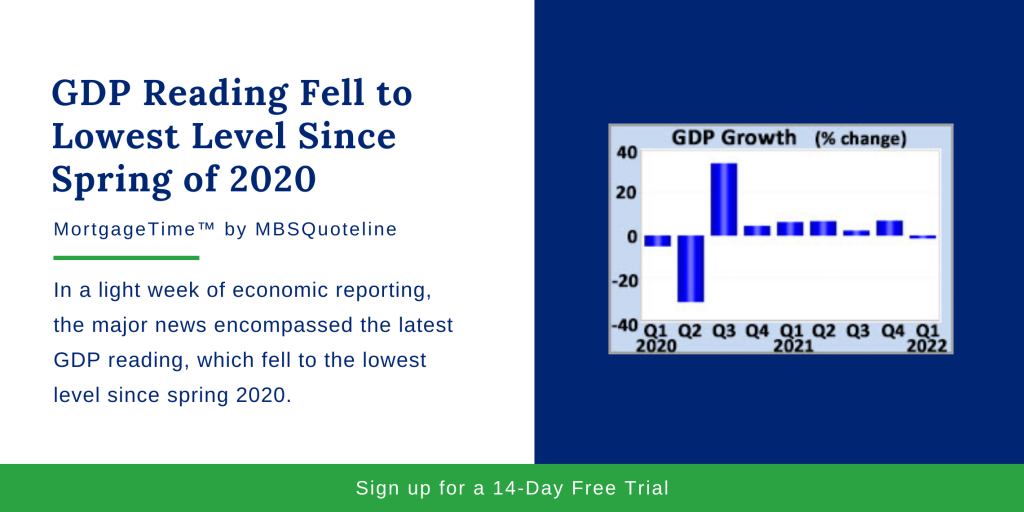

Gross Domestic Product (GDP) dictates the broadest measure of economic activity. During the first quarter, GDP fell at an annualized rate of 1.4%.

Conclusively GDP declined well below the consensus forecast for an increase of 1.0%, and down from outsized growth of 6.9% during the fourth quarter. Overall, this represented the weakest reading since the spring of 2020 when the pandemic caused a partial shutdown of the economy.

GDP Reading Fell Due to Supply Chain Issues

While the headline number for GDP was disappointing, it is necessary to look below the surface at the different components to evaluate the underlying strength of the economy. In this case, an unexpectedly large decline in inventories spurred the GDP shortfall. However, analysts view the inventory decline as a temporary factor.

For example, manufacturers failed to produce enough cars. Because of this, manufacturers fell short of meeting demand due to supply chain disruptions. As a result, dealerships sold fewer cars, while simultaneously shrinking inventories. Having said that, demand remained solid. Investors expect that future sales will ramp up as production capacity increases. In short, economic activity was simply postponed, so the reaction in financial markets was minor.

Core PCE Climbs Year-Over-Year

As the GDP reading fell, core PCE continued to rise. The Federal Reserve favors the PCE price index as its go-to inflation indicator. In March 2022, core PCE rose 5.2% higher than a year ago. Despite the rise, March core PCE decreased from February’s 5.3%, the highest annual rate since 1983.

For comparison, readings fell below 2.0% during the first three months of 2021. Investors question whether inflation will moderate as pandemic-induced disruptions clear up. Additionally, they wonder whether challenges induced by the Russia-Ukraine War will concurrently resolve as the matter does.

Looking Ahead After GDP Reading Fell

After the latest GDP reading fell, investors look ahead to the Wednesday Federal Reserve meeting. At the meeting, investors widely expect a 50-basis point increase in the federal funds. In addition, investors still seek additional guidance on the pace of future rate hikes and balance sheet reduction.

Beyond that, the ISM national manufacturing index comes out on Monday. Later, the ISM national service sector index publishes on Thursday. Finally, the key Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation contain the most highly anticipated economic data of the month.

As the latest GDP reading fell, mortgage rates ended the week relatively unchanged. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.