In a week marked by a lack of significant economic developments, housing starts surged. Meanwhile, mortgage markets experienced a period of relative calm, with rates remaining largely unchanged. Chair Powell’s semi-annual testimony to Congress provided insights into the Federal Reserve’s monetary policy tightening cycle, indicating a potential end in sight.

As the housing sector continued to grapple with challenges, both existing-home sales and new construction showed mixed signals. Investors eagerly anticipate further clarity on the Fed’s future plans, while keeping an eye on upcoming economic indicators.

Chair Powell Hints at Potential Pause in Monetary Policy Tightening

During Chair Powell’s testimony to Congress, indications emerged that the Federal Reserve may be nearing the conclusion of its current monetary policy tightening cycle. Having raised the federal funds rate by a substantial 500 basis points over ten consecutive meetings, the Fed opted to maintain the status quo at its recent meeting on June 14th.

Powell suggested that if the economy performs as expected, two additional 25 basis point rate hikes could be anticipated this year. Factors such as ongoing economic activity and inflation levels below initial projections have led to the necessity for further tightening. Market expectations now point towards a 25 basis point rate hike at the next meeting scheduled for July 26th.

Existing Home Sales Show Marginal Improvement Amidst Low Inventory

May witnessed a slight increase in sales of existing homes compared to April. That said, the figures remained 20% lower than last year. Nationally, inventory levels stand at a meager 3.0-month supply, significantly below the balanced market benchmark of a 6-month supply.

The chief economist of the National Association of Realtors highlighted that the current supply of existing homes fell to approximately half the pre-pandemic level recorded in 2019. Notably, the median existing-home price experienced a 3% decline year-over-year, reaching $396,100. This figure marked a decrease from the record high of $413,800 recorded in June 2022, representing the most substantial annual decline in home prices since 2011.

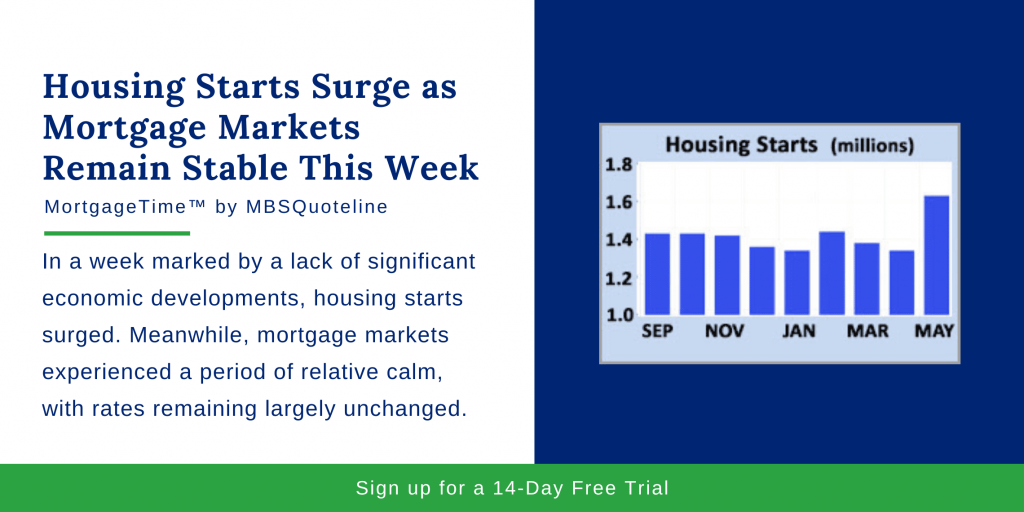

Housing Starts Surge Amidst Supply Shortage

Builders responded to the scarcity of available previously owned homes for sale by increasing their focus on new construction. In May, housing starts surged significantly. Statistically, housing starts experienced a remarkable 22% rise from April, reaching the highest level since April 2022. Additionally, building permits, considered a leading indicator, increased by 5% compared to the previous month.

The National Association of Home Builders’ survey on builder sentiment provided positive news, with sentiment reaching its highest level since July 2022. Currently, new homes account for approximately 35% of sales, significantly higher than the pre-pandemic range of 10% to 15%. However, tight credit conditions for construction loans, as well as elevated prices for land, labor, and materials, present obstacles.

Looking Ahead After Housing Starts Surge

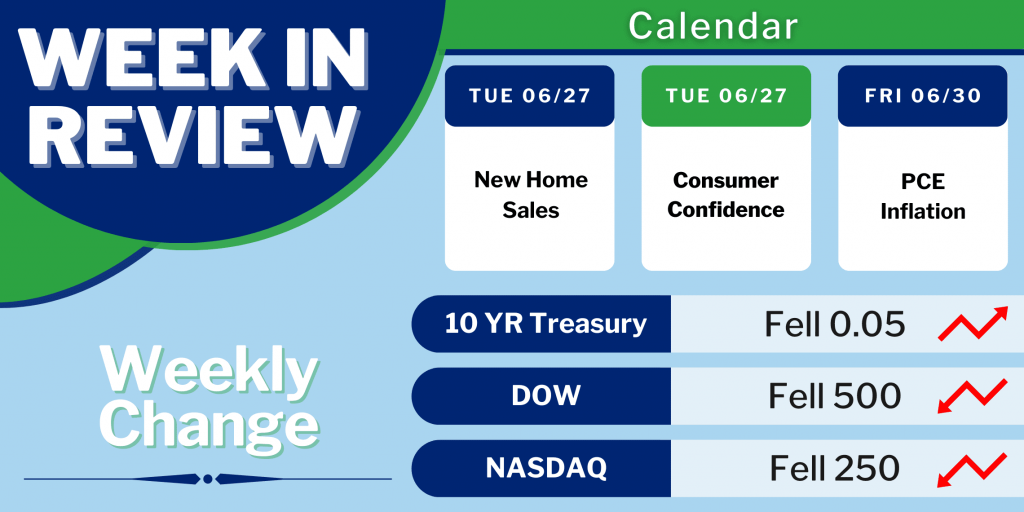

Market participants eagerly await further insights from Federal Reserve officials regarding their plans for future monetary policy. Additionally, key economic indicators such as New Home Sales and Consumer Confidence release on Tuesday.

Furthermore, Personal Income and the PCE price index—the Fed’s favored inflation indicator—publish on Friday. As mortgage markets navigate a period of stability, the housing sector faces low inventory levels and price adjustments.

To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.