The latest economic data highlights the persistence of high inflation and a tight labor market, which has implications for June MBS (mortgage-backed securities). Inflation remains stubbornly high, prompting expectations of additional monetary policy tightening by the Federal Reserve (Fed).

Consequently, mortgage rates have increased. The Fed closely monitors the Personal Consumption Expenditures (PCE) price index. Notably, core PCE, excluding food and energy, rose 4.6% YoY in May. Although this matched consensus forecasts, it marked a slight decrease from the previous month’s 4.7% annual rate. The persistent rise in service costs outpacing goods prices contributes to elevated inflation levels.

Challenges in Reducing Inflation

Despite expectations of a gradual decline, the annual increase in Core PCE has remained well above the Fed’s 2.0% target. Since peaking at 5.2% in September, the rate of increase has plateaued. This sustained high level of inflation has significant implications for financial markets. Particularly, this affects the pace of the Fed’s aggressive monetary policy tightening.

The Department of Labor’s weekly report on new claims for unemployment insurance reveals a promising figure of just 239,000 claims, the lowest since May and below consensus forecasts. This initially hinted at a potential loosening of the labor market, but subsequent readings dashed those hopes, leading investors to revise their expectations for future Fed rate hikes.

Housing Market and Upcoming Economic Reports

The scarcity of previously owned homes on the market continues to dominate the housing sector. Realtor.com data shows that new listings in late June were 29% lower YoY, benefiting home builders. In May, sales of new homes unexpectedly surged by 12% from April, reaching their highest level since March 2022 and surpassing last year’s figures by 20%. These dynamics in the housing market have implications for mortgage-backed securities.

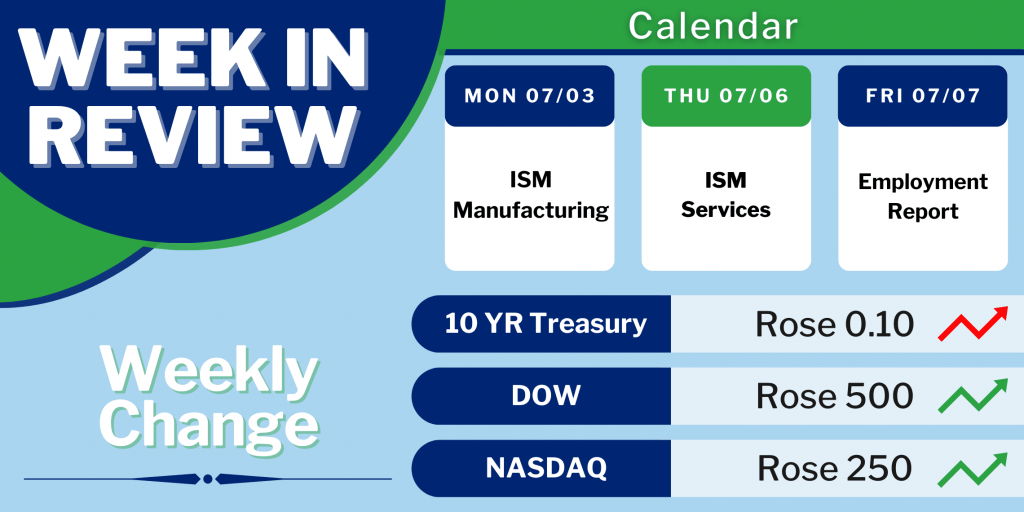

Investors eagerly await further clarity on the Fed’s monetary policy plans. Key economic reports to watch include the ISM national manufacturing index on Monday and the ISM services sector index on Thursday. However, the most highly anticipated data of the month is the Employment report, which will be released on Friday. It will provide crucial insights into job numbers, the unemployment rate, and wage inflation.

Looking Ahead After Latest News Surrounding June MBS

The current economic landscape, characterized by high inflation and a tight labor market, has influenced mortgage rates and mortgage-backed securities. Investors should closely monitor these factors as they navigate the market.

Additionally, upcoming economic reports will provide valuable insights into the trajectory of the economy and its potential impact on mortgage-backed securities.

To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.