As the Fed paused rate hikes, mortgage markets experienced a volatile week. Despite daily movements that roughly offset each other, mortgage rates concluded the week with a slight increase.

Fed Pauses Rate Hikes in June 2023

Over the past ten meetings, the Federal Reserve had been aggressively raising the federal funds rate by 500 basis points. However, recent indications from Fed officials hinted at a potential slowdown. Investors anticipated that the Fed would maintain the federal funds rate this week while signaling the possibility of a 25 basis point increase in the future.

As expected, the Fed decided to “pause” and take more time to evaluate the impact of the previous tightening measures. However, officials displayed a more hawkish stance on monetary policy than anticipated. Their forecasts revealed plans for two additional 25 basis point rate hikes this year. Additionally, they predicted prolonged period of higher rates.

Consumer Price Index Records 4.0% Year-Over-Year Increase

In May, the Consumer Price Index (CPI), a widely monitored inflation gauge, recorded a 4.0% year-over-year increase. As a result, this fell in line with consensus expectations. This figure represented a decline from the 4.9% annual rate observed in the previous month. Moreover, it marked the smallest increase since March 2021. The drop in the annual inflation rate was primarily driven by a substantial decline in energy prices.

To better gauge short-term volatility, investors often focus on core CPI, which excludes food and energy components. In May, core CPI matched consensus forecasts with a year-over-year increase of 5.3%. Although this figure has declined from its peak of 6.6% in September 2022, it remains significantly above the 2.0% levels observed earlier in 2021, which is the Fed’s target level.

Retail Sales Reports Moderate 0.3% Increase

Given that consumer spending constitutes a significant portion of the U.S. economy, retail sales data serves as a vital indicator of economic health. In May, retail sales experienced a moderate 0.3% increase compared to April, surpassing the consensus forecast, which had anticipated a slight decline.

Notably, restaurants and bars demonstrated another strong month, while sales of building materials and garden equipment experienced a substantial 2.2% surge, benefiting from the spring season.

Looking Ahead After Fed Pauses Rate Hikes

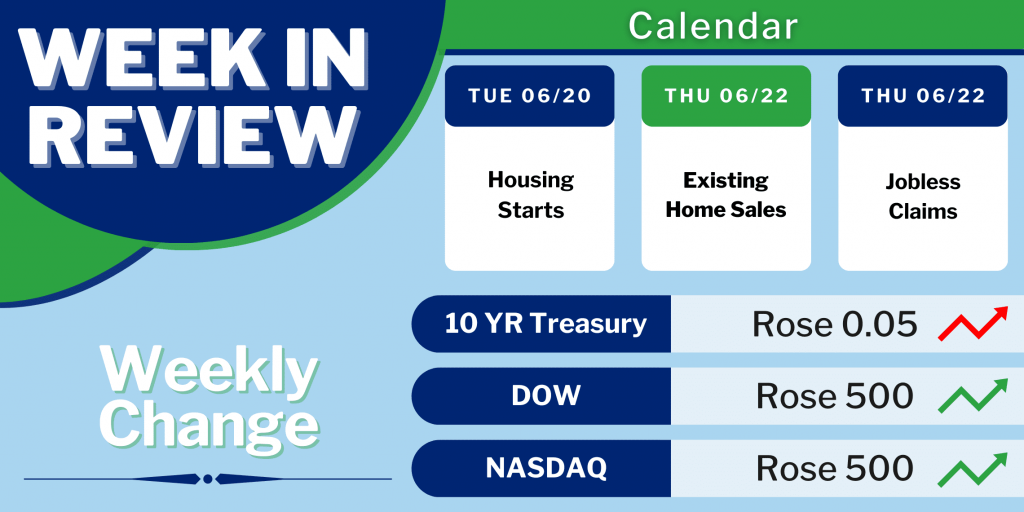

Moving forward, investors will closely monitor the Federal Reserve’s future monetary policy plans as they seek further elaboration from officials. This week’s economic data releases will primarily focus on the housing sector, with Housing Starts scheduled for Tuesday and Existing Home Sales for Thursday. Please note that mortgage markets will be closed on Monday in observance of Juneteenth.

To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.