After a muddling 2022, refinance applications soared 10% week-over-week. This showed signs of life in the mortgage industry.

Additionally, investors focused on the latest Consumer Price Index data. However, the most recent inflation figures fell right in line with expectations. Thus, mortgage rates ended with little change.

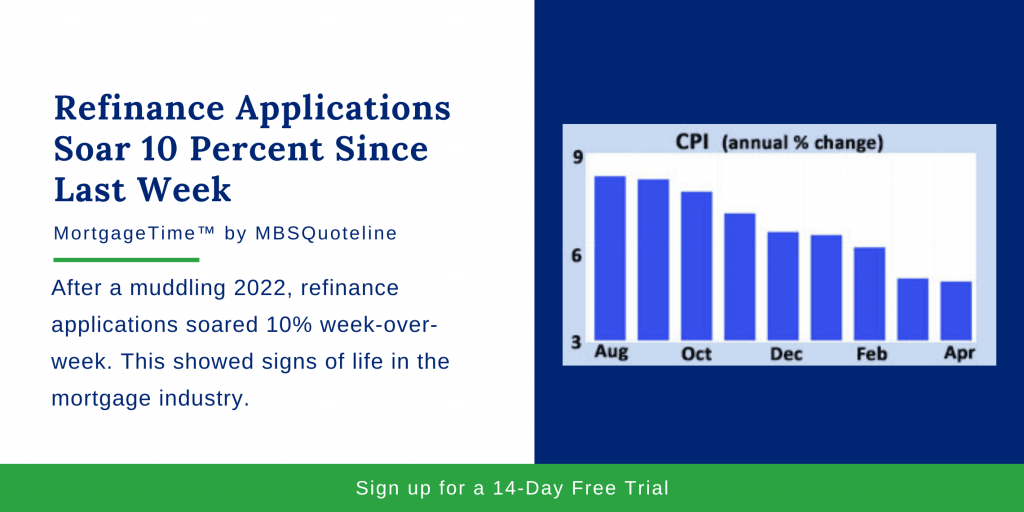

Consumer Price Index Sees Smallest Rate of Increase Since April 2021

In April, the Consumer Price Index (CPI), one of the most widely followed inflation indicators, was 4.9% higher than a year ago, down from 5.0% last month.

This was the smallest annual rate of increase since April 2021. While this annual rate has fallen from a peak of 9.1% in June 2022, it remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed.

Elevated Inflation Reflects Price Increases Across Shelter and Automotive Segments

Since overall inflation is still elevated, it is not surprising that the majority of individual components continued to show significant price increases.

In particular, shelter (housing) costs remained stubbornly high and again were responsible for the largest portion of the increase. Used car and gasoline prices also rose substantially from March. By contrast, food prices were flat from the prior month.

Refinance Applications Jump 10% as Purchase Applications Climb

Mortgage activity, which was recently at the lowest levels in 25 years, has picked up a bit lately. According to the latest data from the Mortgage Bankers Association (MBA), purchase applications rose 5% from last week, yet are still down 32% from last year at this time.

Applications to refinance jumped 10% from the prior week but remain down 44% from one year ago.

Looking Ahead After Refinance Applications Jump

Investors will continue to keep a close eye on the banking sector for signs that troubles are spreading to other institutions. They will also watch to see if Fed officials elaborate on their plans for future monetary policy.

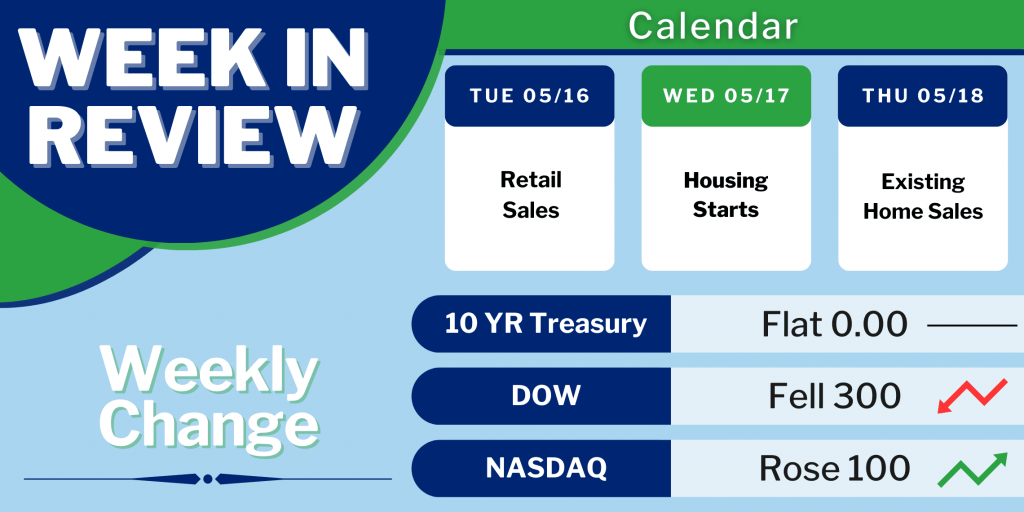

The biggest economic report released next week will be Retail Sales on Tuesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. In addition, Housing Starts will come out on Wednesday and Existing Home Sales on Thursday.

While refinance applications rose 10% week-over-week, mortgage rates stayed roughly the same. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.