Alongside a wide range of major economic news, another Fed rate hike created a volatile week for mortgage markets. However, the significant economic data produced a small net impact. Ultimately, mortgage rates ended the week with surprisingly little change.

Another Fed Rate Hike Leads to 25-Basis Point Increase

With troubles in the banking sector rising to the surface again, another Fed rate hike came to fruition. Sticking to the script, the Federal Reserve increased the federal funds rates by 25 basis points. Currently, the federal funds rate has achieved its highest level since August 2007. That said, the Federal Reserve plans to keep their options open regarding further increases.

According to the meeting statement, future monetary policy depends on incoming economic data and “developments” in the banking industry. During the press conference, Chair Powell said that “a decision on a pause was not made today.” Now, most investors anticipate that this was the last rate hike.

Further Economic News from Employment and ISM

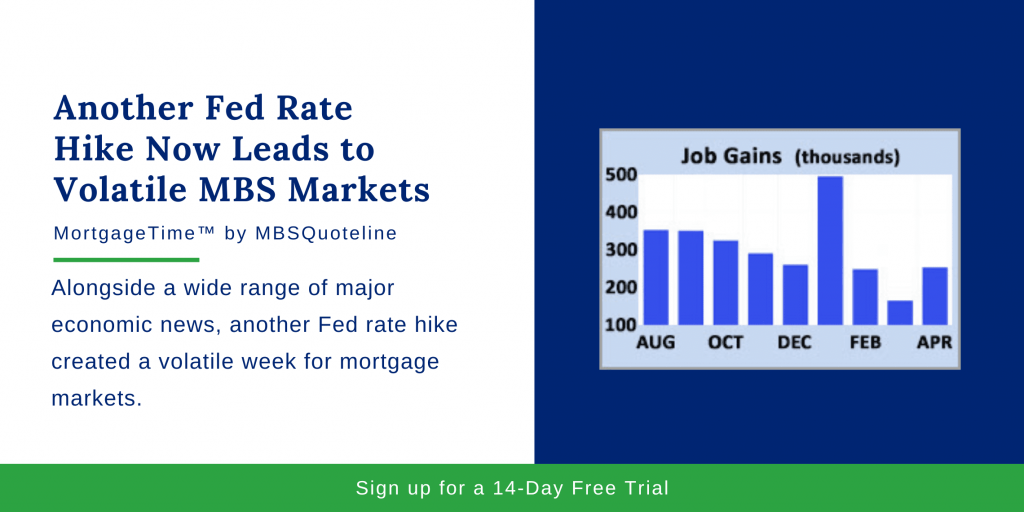

The latest Employment report revealed moderate job gains and stronger than expected wage growth. The economy added 253,000 jobs in April, above the consensus forecast, but downward revisions reduced the results for prior months. In addition, the professional services, health care, and leisure demonstrated particular strength. Also, the unemployment rate unexpectedly dropped from 3.5% to 3.4%, matching the lowest level since 1969. Average hourly earnings, an indicator of wage growth, increased 0.5% from March, well above the consensus forecast. Holistically, they climbed 4.4% higher than a year ago, up from an annual rate of 4.2% last month.

Two other significant economic reports released this week, from the Institute of Supply Management, fell in line with expectations. The ISM national services sector index came in at 51.9. Meanwhile, the ISM national manufacturing index hit 47.1. Since readings above 50 indicate an expansion in the sector and below 50 a contraction, this data continues to highlight the consumer preference for services over goods.

Looking Ahead After Another Fed Rate Hike

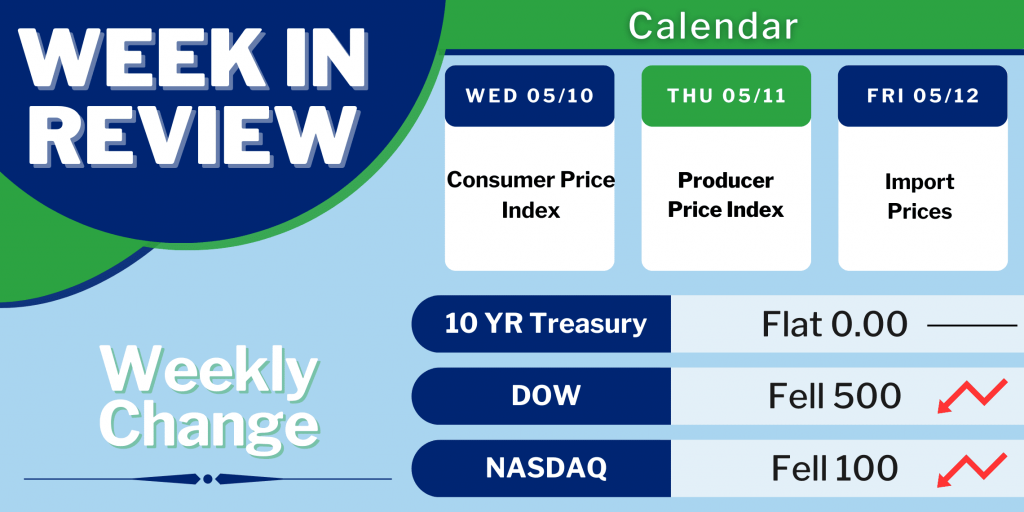

Following another Fed rate hike, investors closely watch the banking sector for signs of spreading trouble. Moreover, investors watch for further monetary policy insight from the Federal Reserve.

Beyond that, the Consumer Price Index (CPI) report comes out on Wednesday. As a widely followed inflation indicator, CPI looks at the price changes for a broad range of goods and services.

Despite volatile market activity and another Fed rate hike, mortgage rates saw little change. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.