Consumer prices in Europe leave investors disappointed, as they were hoping for signs that inflation is easing. As a result, mortgage rates climbed a bit to the highest levels since November.

Consumer Prices Rise In Europe

Eurozone consumer prices in February were 8.5% higher than a year ago, well above the consensus of 8.2%. Excluding the volatile food and energy categories, core inflation jumped to a record high annual rate of 5.6%, up from 5.3% during the prior month. In short, the high readings clearly supported more monetary policy tightening by the European Central Bank, and investors raised their outlook for future rate hikes.

Consumer Prices & Inflation Slow Mortgage Applications

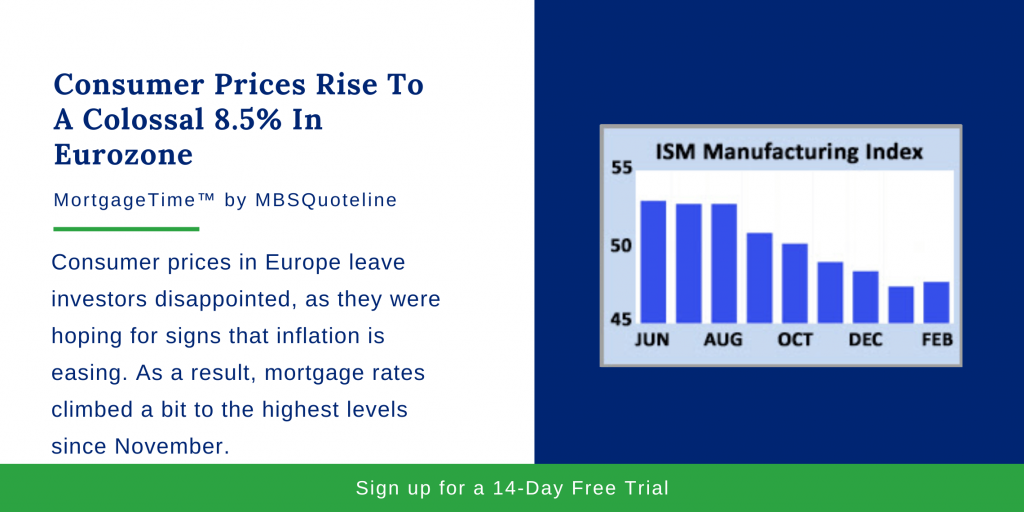

Outside of consumer prices, perhaps the most significant economic report released this week was close to expectations. The ISM national manufacturing index rose a little to 47.7, but levels below 50 points to that the sector is contracting. The negative reaction for mortgage rates, is due to a large increase in the prices paid component of the report.

It should come as no surprise that mortgage rates have a huge impact on application volumes. When rates lowered in January, applications shot higher. Over the last month, however, rates have jumped again. With high consumer prices and unmoving inflation, a heavy damper hit housing market activity. According to the latest data from the Mortgage Bankers Association (MBA), purchase applications are down 44% from last year at this time, at the lowest level in 28 years. Even worse, applications to refinance are down a massive 74% from one year ago.

What’s To Come

After the Eurozone’s latest news on consumer prices came out, investors closely watch to see if Fed officials expand on their plans for future rate hikes. The key Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated data of the month. Before that, the Trade Deficit and the JOLTS (job openings) data will come out on Wednesday.

As consumer prices rose, so, too, did mortgage rates. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.