Mortgage rates climbed to the highest levels since November 2022. The spike is directly due to the major inflation data released this week. The data on inflation was stronger than expected.

Mortgage Rates Go Up

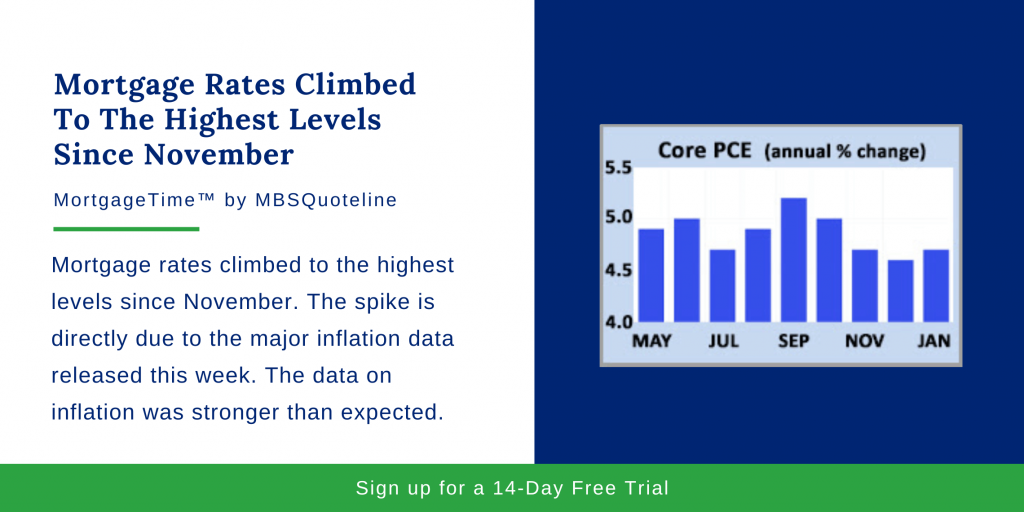

In January, core PCE, was up 4.7% from a year ago, far above the consensus forecast of 4.3%. This was the highest annual rate since October 2022. As a result, mortgage rates climbed to this highest level since November.

The annual rate of increase in Core PCE remains far above the Fed’s target level of 2.0%. Since September, it had been steadily declining each month. The latest data broke the streak with a small increase from the annual rate of 4.6% seen in December. While investors thought that it would continue to ease, Fed officials have warned that the battle will be difficult. This is particularly relevant because how quickly their aggressive monetary policy tightening will bring down inflation has enormous implications for financial markets.

Mortgage Rates & Home Inventory Dismal

As mortgage rates climbed, sales of existing homes, which make up about 90% of the market, fell for the twelfth straight month in January. This represents the lowest level since 2010. Also, existing home sales plunged 37% lower than last year at this time. High mortgage rates along with inventory levels remained a big trouble spot. While they were 15% higher than a year ago, they remained at just a 2.9-month supply nationally. Still far below the roughly 6.0-month supply, typically seen in a balanced market.

The median existing-home price of $359,000 was just 1.3% higher than last January. Down from a record high of $413,800 in June. This was the smallest annual rate of price appreciation since 2012, and economists forecast that we will soon see year-over-year price declines. New home sales, accounting for the remaining 10% of the market, surprised investors with a gain of 7% from December, despite high mortgage rates.

Looking Ahead

After mortgage rates climbed again, investors watch for Fed guidance on future rate hikes. The ISM national manufacturing index will be released on Wednesday and the ISM national services sector index on Friday. Often released on the first Friday of each month, the key Employment report instead is scheduled for March 10.

After the publication of the latest inflation data, mortgage rates climbed to their highest levels since November 2022. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.