Following this week’s September 2022 Core PCE report, investors scaled back their outlook. Despite the annual increase, the data matched the consensus.

Now, investors anticipate a slightly less aggressive pace of monetary policy tightening from global central bankers. Thus, mortgage rates ended the week lower.

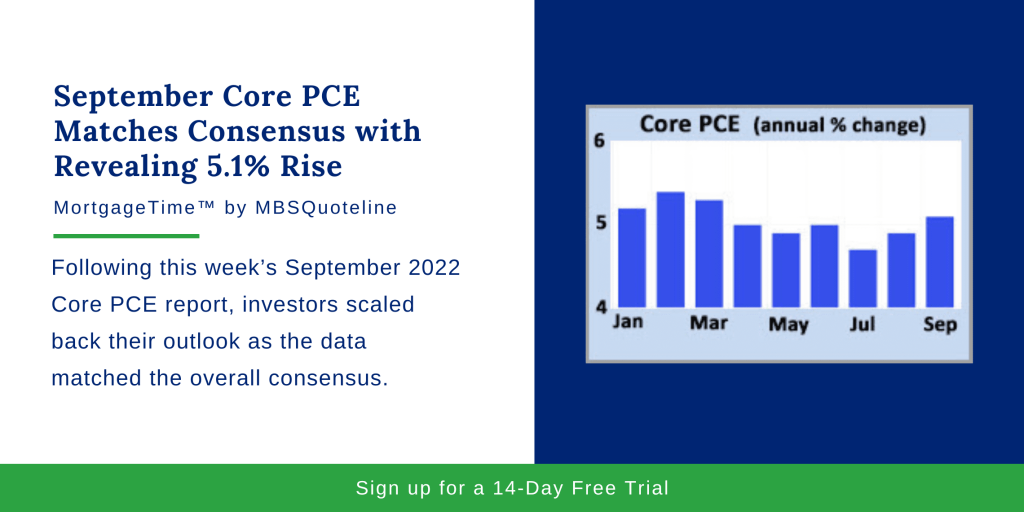

September 2022 Core PCE Matches Overall Consensus

Notably, the PCE price index adjusts for changes in consumer preferences over time. Due to this consideration, the Federal Reserve favors the PCE price index as its go-to inflation indicator. Overall, the September 2022 Core PCE increased 5.1% from a year ago, matching expectations. Additionally, this statistic declined from February 2022’s peak of 5.4%.

However, Core PCE remains far above the Fed’s target level of 2.0%. Moving forward, investors still debate the impact of tighter monetary policy on inflationary pressures.

GDP Demonstrates Strength for Trade and Consumer Spending

Along with the September 2022 Core PCE report, the latest Gross Domestic Product (GDP) came out. By definition, GDP represents the broadest measure of economic activity. During the third quarter, GDP rose at an annualized rate of 2.6%. Therefore, GDP rose above the consensus forecast for an increase of 2.3%.

Holistically, this marks an improvement from a decline of 0.6% during the second quarter. Looking industry-wide, trade and consumer spending demonstrated particular strength. Meanwhile, residential investment (housing) remained a source of weakness.

European Central Bank Raises Interest Rates to Highest Level Since 2009

Aside from the September 2022 Core PCE and GDP, the European Central Bank (ECB) raised benchmark interest rates by the widely expected 75 basis points on Thursday. In their efforts to combat inflation, the ECB increased rates to the highest level since 2009. Investors felt more uncertain about the ECB’s bond purchase program.

Unlike the United States Federal Reserve, the ECB continually delays its bond portfolio reduction. Furthermore, some investors thought that the ECB would announce a start date at Thursday’s meeting. However, officials decided to wait until the December meeting to discuss the conditions for further tightening monetary policy by shrinking the bond portfolio. This delay in a reduction in the demand for bonds proved favorable for global yields, including U.S. mortgage rates.

Looking Ahead After September 2022 Core PCE Report

After the release of the September 2022 Core PCE report, investors look towards Wednesday’s Federal Reserve meeting. While investors expect another 75-basis point rate increase, they hope for specific guidance on the pace of future rate hikes and bond portfolio reduction.

Next week, the ISM national manufacturing sector index comes out on Tuesday. Later, the ISM national services sector index publishes on Thursday. Finally, the key Employment report releases on Friday. As always, these figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated economic data of the month.

In the aftermath of the September 2022 Core PCE data, mortgage rates decreased slightly by the end of the week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.