In another volatile week for mortgage markets, the conflict in Ukraine continued to intensify. Also, the United States heard key testimony from Federal Reserve Chair Powell. While the latest labor market report came out, it had a much smaller impact compared to the situation in Ukraine. As a result, mortgage rates ended the week lower.

Conflict in Ukraine Intensifies

In response to geopolitical events, such as the conflict in Ukraine, investors generally seek to reduce the level of risk in their portfolios. This week, news which indicated greater Russian military action caused investors to shift from stocks to relatively safer assets.

In doing so, demand for bonds increased. This increased demand for mortgage-backed securities (MBS), generated a favorable effect for mortgage rates.

Fed Chair Powell Supports 25-Basis Point Increase

On Wednesday, highly anticipated testimony to Congress from Chair Powell shaped the investor outlook for future Fed policy. Some investors thought that a 50-basis point rate hike was still a possibility. Powell clearly supports raising the federal funds rate by 25 basis points at the March 16th meeting. Later, he expects the action to be followed by a series of additional 25 basis point increases.

Powell left the possibility of larger rate hikes in the future if inflation does not decline at the anticipated pace. In addition, he said that the massive balance sheet holdings of Treasuries and mortgage-backed securities (MBS) will be reduced “in a predictable manner.” Finally, Powell commented that the conflict in Ukraine is “highly uncertain.”

Impact of Employment & ISM Reporting

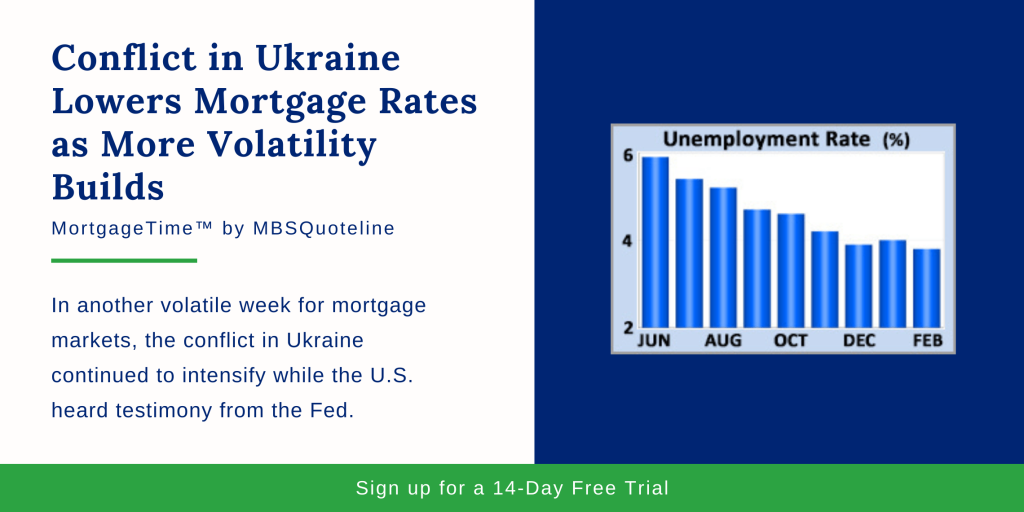

Aside from the conflict in Ukraine, the closely watched Employment report released on Friday. Against a consensus forecast of 400,000, the economy gained 678,000 jobs in February. The unemployment rate unexpectedly fell from 4.0% to 3.8%. Average hourly earnings rose 5.1% higher than a year ago, down from an annual rate of 5.5% last month. In conclusion, average hourly earnings fell far below the consensus forecast of 5.8%.

Meanwhile the Institute of Supply Management (ISM) reports remained at high levels by historical standards. The national service sector index came in at 56.5 and the national manufacturing index at 58.6. Levels above 50 indicate that the sectors are expanding, and readings above 60 are rare.

Looking Ahead After News on Conflict in Ukraine

After the latest news on the conflict in Ukraine, investors look for additional Fed guidance on the pace of future rate hikes. Simultaneously, investors seek insight on the Fed’s balance sheet reduction. Beyond that, the JOLTS report, which measures job openings and labor turnover rates, comes out on Wednesday.

Later, the next European Central Bank meeting takes place on Thursday. The Consumer Price Index (CPI) also publishes on Thursday. Investors widely follow CPI as a monthly inflation indicator that examines the price changes for a broad range of goods and services.

As the conflict in Ukraine develops, mortgage rates declined over the past week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.