Mortgage markets experienced another volatile week as the Russian invasion of Ukraine dominated headlines. However, the daily movements offset one another. Thus, mortgage rates ended the week with little change. As a result, mortgage rates remain at the highest levels since the middle of 2019.

Russian Invasion of Ukraine

Headlines concerning the Russian invasion of Ukraine held heavy influence over mortgage rates, especially on Thursday. When tensions increased, investors reduced risk by shifting from stocks to relatively safer assets such as bonds.

This increased demand for mortgage-backed securities (MBS). The increased demand for MBS created a favorable effect for mortgage rates. On the other hand, news alluding to reduced tensions had the opposite effect.

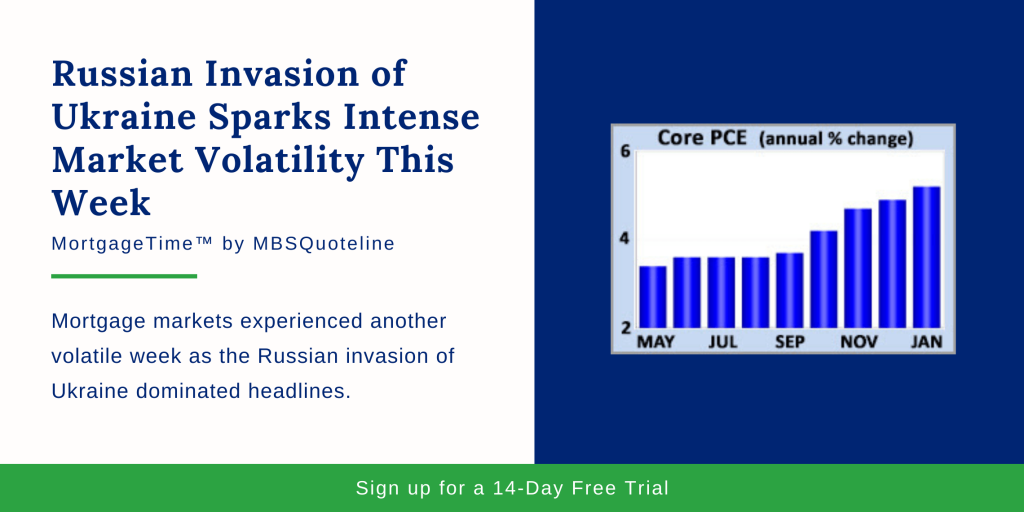

Inflation Reaches Highest Annual Rate Since 1983

As the Russian invasion of Ukraine commences, core PCE reached its highest annual rate since 1983. Generally, the Federal Reserve favors the core PCE price index as its go-to inflation indicator.

In January 2022, core PCE rose 5.2% higher than a year ago, up from 4.9% last month. For comparison, readings fell below 2.0% during the first three months of 2021. Now, investors wonder how quickly inflation will moderate as pandemic-related disruptions clear up.

Backlog of Approved Home Construction Reaches Record-High

Aside from the Russian invasion of Ukraine and soaring inflation, sales of new homes fell 5% in January to an annualized rate of 806,000, near the consensus forecast. New home sales peaked at a rate of 993,000 units in January of last year, the highest level since 2006.

The median new home price jumped 13% higher than last year at this time at $423,300. Also, the backlog of new homes approved for construction but not yet started rose to a record high of 26%. Higher prices and shortages for key inputs, such as lumber and appliances, restrained the pace of building.

Looking Ahead as Russian Invasion of Ukraine Continues

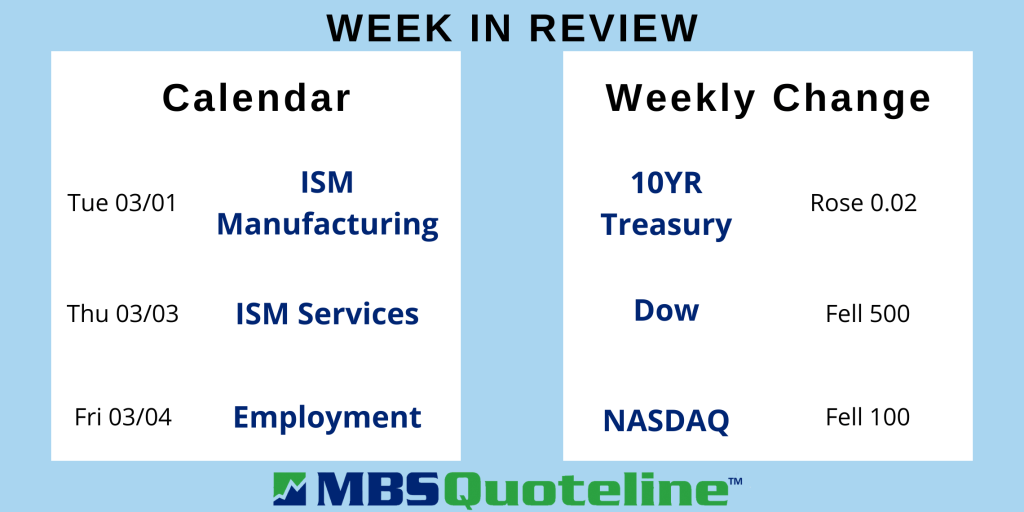

Looking ahead, investors plan to closely follow news on the Russian invasion of Ukraine. In addition, investors seek additional Fed guidance on the pace of future rate hikes and balance sheet reduction.

On the economic front, ISM national manufacturing index comes out on Tuesday. Later, the ISM national service sector index publishes on Thursday. Beyond that, the key Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation represent the most highly anticipated economic data of the month.

Following the latest news on the Russian invasion of Ukraine, mortgage rates hover at their highest point since the middle of 2019. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.