Despite the ongoing coronavirus pandemic, recent data reflects an emerging housing market across the United States. This week, the housing and inflation data released this week contained no major surprises. In addition, investors mostly focused on the concerning coronavirus increase throughout several states. With a quiet week for mortgage markets, mortgage rates ended slightly lower.

Emerging Housing Market

Although mixed real estate data came out this week, the evidence clearly supported an emerging housing market. Noticeably, the expected housing recovery continually moves faster than anticipated. On the optimistic front, recent activity fared much better. In May, new home sales, which are based on contracts signed during the month, unexpectedly surged 17% from April. Thus, new home sales rose significantly higher than a year ago.

On the other hand, May existing home sales came in weaker than expected with a decline of 10% from April, 12% lower than a year ago. Simultaneously, existing home sales report confirmed that housing market activity dropped sharply in March and April due to the shutdown of much of the economy. Overall, existing home sales measure closings. Generally, buyers sign contracts for homes that close in May right around now.

Mortgage Rates Hover Near Record-Low Levels

Aside from the emerging housing market, both Freddie Mac and the Mortgage Bankers Association reported that average rates for 30-year fixed-rate mortgages remained near record low levels this week. In addition, the MBA revealed that applications to purchase a home increased a solid 18% higher than a year ago at this time. Also, refinance applications skyrocketed a stunning 76% higher.

The reduced economic activity resulting from the pandemic caused a decline in inflation. Therefore, mortgage rates stayed low. In May, the core PCE price index climbed just 1.0% higher than a year ago, which was the same annual rate of increase as last month. Core PCE is the indicator favored by the Fed. Officials have stated that their target level for annual inflation is 2.0%.

Looking Ahead After News on Emerging Housing Market

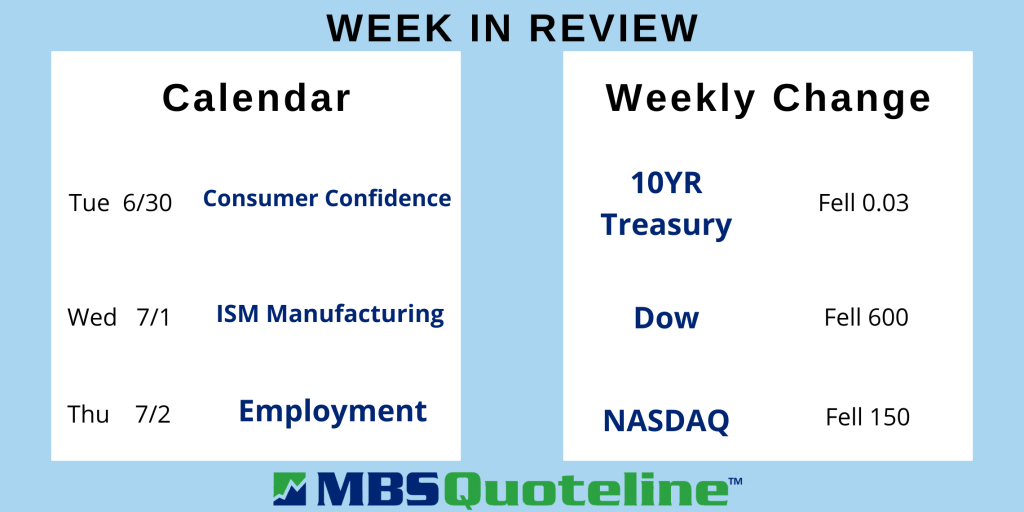

After the news on the emerging housing market, investors continue to watch for news about medical advances, government stimulus programs, Fed monetary actions, and plans for reopening the economy. On the economic front, the ISM national manufacturing index releases on Wednesday.

In addition, the monthly Employment report publishes on Thursday. These figures on the number of jobs, the unemployment rate, and wage inflation represent the most highly anticipated economic data of the month. Mortgage markets close on Friday in observance of Independence Day.

Following the latest news on the emerging housing market, mortgage still hover near record-lows. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.