The latest data saw GDP triumph over forecasts, reflecting stronger economic growth this quarter. However, GDP’s impressive data created an unfavorable reaction for mortgage rates. Also, trade negotiation progress showed negatively. As a result, mortgage rates ended the week higher.

GDP Triumphs Over Forecasts

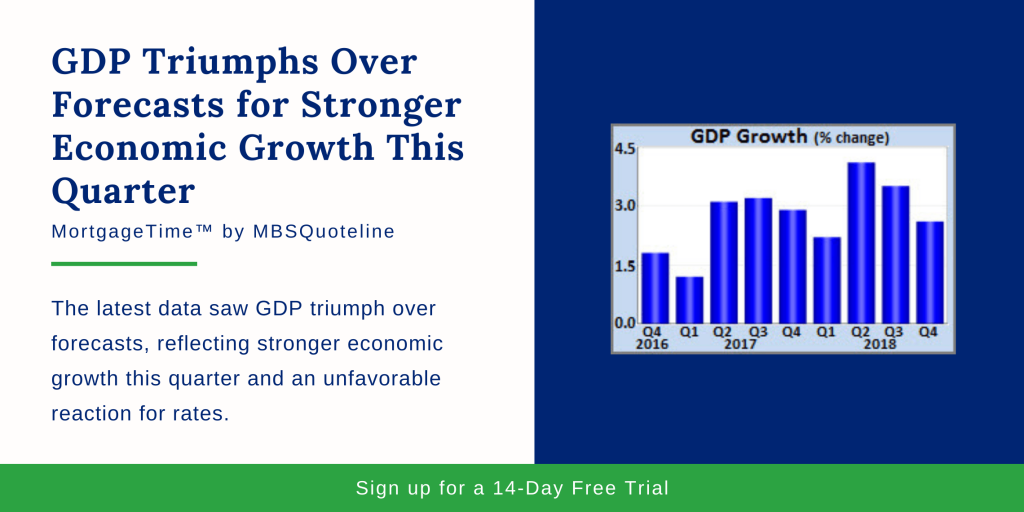

Gross Domestic Product (GDP) represents the broadest measure of economic growth. Due to the government shutdown, data from 2018’s fourth quarter faced a delay. However, it was worth the wait. GDP triumphed over forecasts, increasing 2.6% during the fourth quarter. While it declined from 3.4% in the third quarter, this number exceeded the consensus forecast for a reading close to 2.0%. Additionally, business investment and exports realized unexpected strength.

For the year, GDP growth saw a solid 2.9%. in conclusion, GDP achieved its highest level since 2015. Early forecasts for 2019 generally show slower growth below 2.5%. because of the fading stimulus effects from U.S. tax cuts and economic weakness overseas, GDP takes a hit.

Housing Constructions Reveals Disappointing News

Aside from GDP’s triumph over forecasts, the latest home construction data revealed disappointing news for activity at the end of 2018. Although the December housing starts data similarly faced shutdown-related delays, it showed an unexpectedly large decline of 11% from November. Ultimately, housing starts plummeted to their lowest level since September 2016.

Single-family starts fell 7% from November. Meanwhile, the more volatile multi-family segment dropped 20%. Building permits for single-family homes represent a leading indicator of future construction. Having said that, building permits decreased a little from November.

President Trump Postponed Tariff Increase

While GDP triumphed over its forecasts, President Trump postponed the increase in U.S. tariffs on Chinese goods as expected. Originally, he had scheduled these tariffs to take place on March 1st.

According to trade officials, the U.S. will “suspend the scheduled tariff increase until further notice.” Analysts anticipate faster economic growth if the United States and China reach a trade deal. Overall, faster growth raises the outlook for future inflation. As a result, the signs of progress in the negotiations seen this week left a negative effect for mortgage rates.

Fed Remains Patient with Monetary Policy

Despite GDP triumphing over forecasts, Fed Chair Jerome Powell did not provide any new information about future monetary policy in his semi-annual testimony to Congress on Tuesday and Wednesday. Powell described a healthy outlook for the U.S. economy subject, despite uncertainty in some areas.

These areas include the pace of global growth, the trade negotiations, and Brexit (the British exit from the European Union). He confirmed that Fed officials remain “patient” in assessing the need for additional rate hikes. In addition, Fed Chair Powerll stated that the Federal Reserve draws “close” to agreeing on the appropriate size of the balance sheet.

Looking Ahead After GDP Triumphs Over Forecasts

Looking ahead after GDP triumphs over forecasts, the monthly Employment report releases on Friday. Analysts and investors see these figures on the number of jobs, the unemployment rate, and wage inflation as the most highly anticipated economic data of the month.

Before that, the ISM national services index comes out on Tuesday. The next European Central Bank (ECB) meeting takes place on Thursday. This meeting holds potential influence over U.S. mortgage rates. Finally, investors watch for signs of progress in the trade talks between the U.S. and China.

The government shutdown began on December 22nd. It ended on January 25th. However, the shutdown caused delays in the release of some economic reports produced by government agencies. Delays persist until the affected agencies get caught up. No one knows when the postponed data will be ready to be released.

Want to see how mortgage-backed securities fluctuate as GDP triumphs over forecasts? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.