Notably, this week’s biggest economic story revolved around weakness in the services sector. As revealed by the Institute of Supply Management (ISM) report, the services sector performed worse than expected.

Investors focused on key inflation data and an upcoming Fed meeting, resulting in a relatively quiet week. Despite weaker economic reports, mortgage rates saw a slight increase.

Weakness in Services Sector Indicates Noteworthy Decline

The ISM national services sector index dropped to 50.3, below the forecasted 52.0, marking its lowest level since December 2022. While the reading still indicates slight growth, this decline is noteworthy. With the services sector representing over 75% of the U.S. economic activity, its performance holds great importance compared to the manufacturing sector’s contraction.\

Consumer Spending and Unemployment Claims Reflect Economic Stability

Consumer spending on activities such as trips and entertainment remains steady. This consistent expenditure plays a vital role in maintaining a resilient economy, despite the Federal Reserve’s significant monetary tightening efforts. As the services sector plays a dominant role in economic activity, investors closely monitor consumer behavior to gauge the economy’s overall strength.

The Department of Labor’s weekly report on new unemployment insurance claims revealed a figure of 261,000, surpassing the consensus forecast of 235,000 and marking the highest level since October 2021. While the early pandemic months inflated these figures, current levels align with pre-pandemic readings around 250,000, typical for 2019. This data underscores the ongoing stability of the labor market, contributing to overall economic stability.

Looking Ahead After Weakness in Services Sector

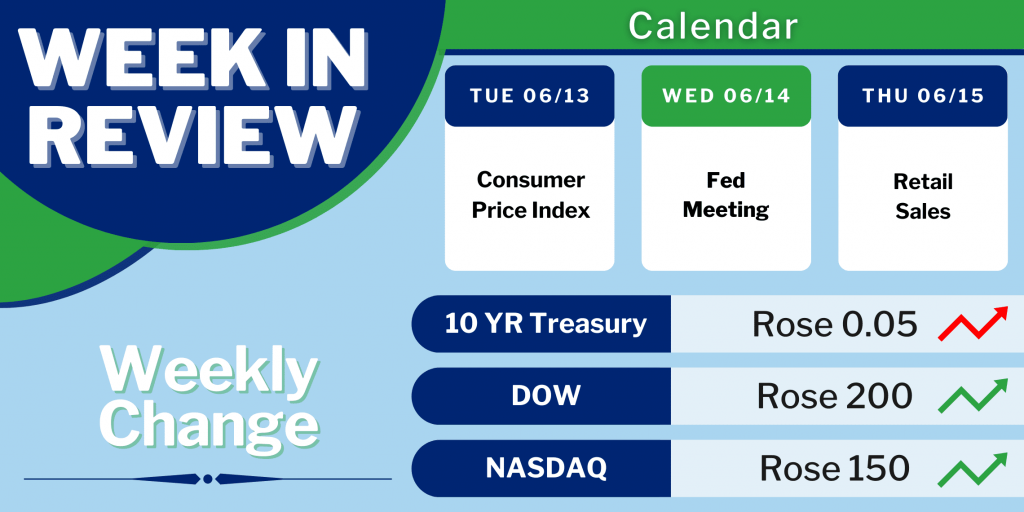

CPI, Fed Meeting, and Retail Sales: Next week promises significant economic events with far-reaching implications. The eagerly awaited Consumer Price Index (CPI) inflation report will be released. This provides insights into price changes for various goods and services. On Wednesday, the Fed meeting will occur, and market expectations vary widely regarding the officials’ statements and actions. Additionally, Thursday will see the release of Retail Sales data. Overall, this reflects a critical measure of economic health as consumer spending drives a substantial portion of the U.S. economic activity.

While this week witnessed weaker economic reports, the focus remains on the services sector’s performance and its impact on the economy. Mortgage-backed securities investors must consider the implications of the services industry’s weakening, particularly in the context of consumer spending and overall economic stability. As the upcoming CPI report, Fed meeting, and Retail Sales data approach, market participants eagerly await crucial insights into the state of the economy and its implications for mortgage-backed securities.

In light of mixed economic news, mortgage rates declined by week’s end. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.