After a notable rise in the initial weeks of May, mortgage rates declined amid mixed economic signals and manufacturing contraction. However, rates showed minimal correlation with specific news events. Alongside this development, recent economic reports have presented mixed signals, with the Employment report revealing conflicting data.

MortgageTime explores the employment figures, wage growth, and the manufacturing sector while shedding light on the implications for mortgage-backed securities.

Employment Report Highlights Strong Job Gains, Yet Rising Unemployment Rate

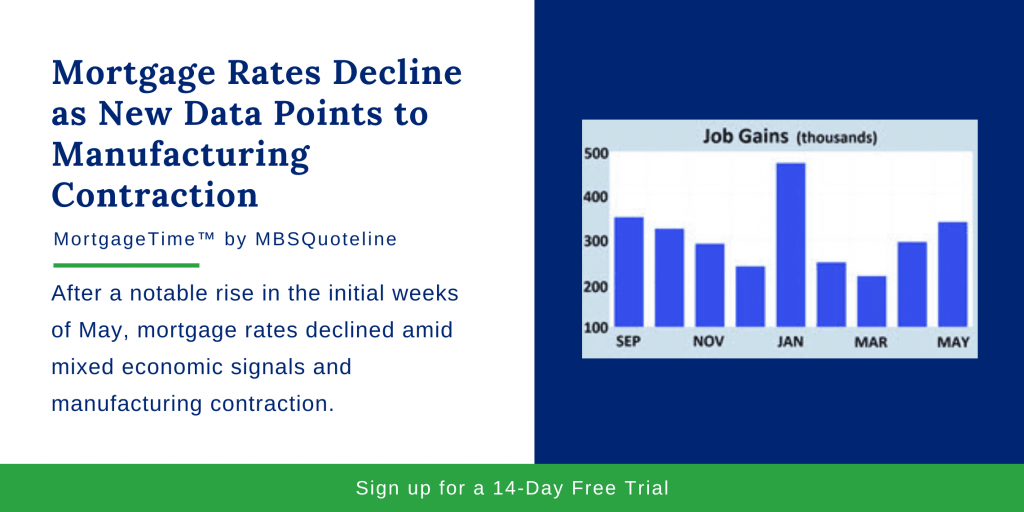

The most recent Employment report for May showcased a noteworthy addition of 339,000 jobs, surpassing the consensus forecast of 180,000. Furthermore, positive revisions for previous months contributed to an overall optimistic outlook. Industries such as professional services, health care, and leisure displayed notable strength in employment gains.

Contrary to the positive job gains, the unemployment rate unexpectedly rose from 3.4% to 3.7%, reaching its highest level since October 2022. However, it is important to note that disparities between job gains and the unemployment rate are not uncommon. These variations stem from job gain calculations based on company data, while the unemployment rate relies on a separate survey of individuals. The increase in the unemployment rate may indicate workers proactively seeking better opportunities, rather than experiencing involuntary job losses. It is crucial to monitor these figures in the coming months to assess the underlying trend’s implications for mortgage-backed securities.

Wage Growth Moderates, Raising Questions for the Fed

Average hourly earnings, a key measure of wage growth, experienced a 0.3% increase from April, aligning with consensus forecasts. Compared to the previous year, wages were 4.3% higher, reflecting a slight decline from the 4.4% annual growth rate observed last month.

Wage growth serves as a crucial indicator for the Federal Reserve (Fed) due to its potential influence on future inflationary pressures. The moderation in wage growth raises questions among investors regarding the likelihood of the Fed raising the federal funds rate by another 25 basis points at the upcoming June 14 meeting. The outcome of this decision will have implications for the mortgage-backed securities market.

Mortgage Rates Decline as Manufacturing Sector Contracts, Services Prevail

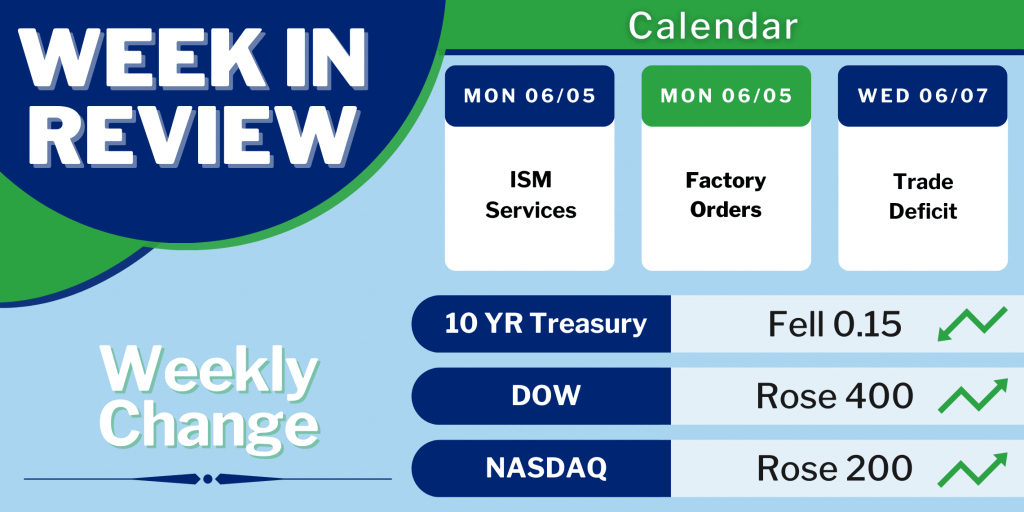

A significant economic report from the Institute of Supply Management (ISM) highlights the challenges faced by the manufacturing sector. The ISM national manufacturing index plummeted to 46.9, a reading below 50 that indicates a contraction in the sector. The preference of consumers for services over goods since the economy’s reopening post-pandemic has contributed to this contraction.

Investors will continue to monitor the banking sector for any signs of trouble. Additionally, they will pay close attention to the Federal Reserve’s communications regarding future monetary policy plans. As the manufacturing sector faces headwinds, the performance of mortgage-backed securities may be influenced by the broader economic landscape.

Looking Ahead After Mortgage Rates Decline

While mortgage rates declined this week, the mixed economic signals demand careful attention. The Employment report’s conflicting data on job gains and the unemployment rate, along with wage growth moderation and the manufacturing sector’s contraction, all contribute to the intricate landscape of mortgage-backed securities.

Investors closely follow economic indicators in the coming weeks. This includes the ISM national services sector index and the Trade Deficit. Conclusively, investors hope to gauge the sector’s trajectory and potential implications for the mortgage market.

In light of mixed economic news, mortgage rates declined by week’s end. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.