Latest mortgage market seemed to finally calm after several weeks of extreme volatility due to concerns about the banking sector.

Latest Mortgage Markets

While investors remained alert for troubles spreading to additional banks, tensions have eased, and the daily swings in mortgage rates have returned to more normal levels. Just as the increased uncertainty earlier in the month caused investors to shift from equities to safer assets (mortgage-backed securities). It seems reduced concerns had the opposite effect, and mortgage rates ended the week higher.

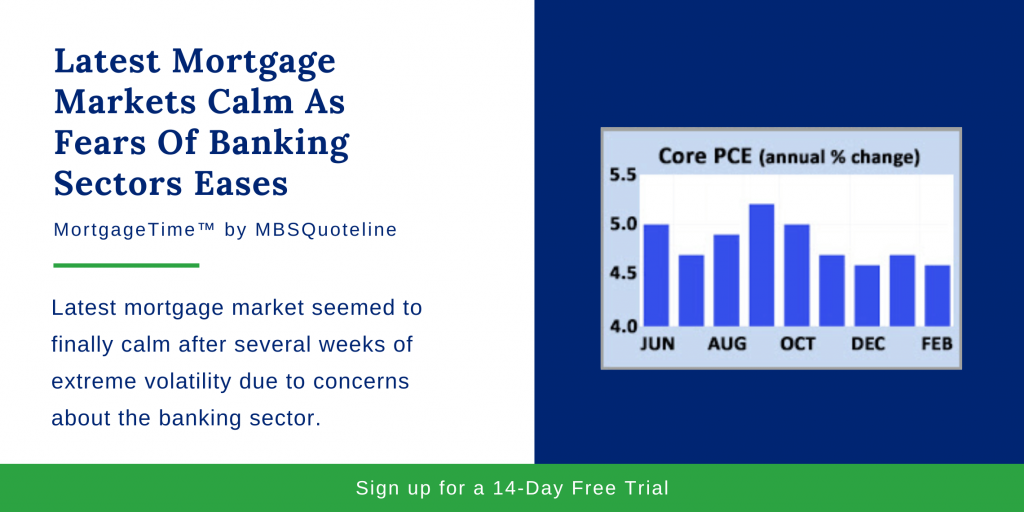

Overall, the Fed favors the PCE price index as its go-to inflation indicator. In February, core PCE, which excludes the volatile food and energy components, was up 4.6% from a year ago. This rose slightly below the consensus forecast, down from an annual rate of 4.7% last month. The cost of services continued to increase more than prices for food and other goods.

Mortgage Activity On The Rise

The annual rate of increase in Core PCE remains far above the Fed’s target level of 2.0%. After peaking in September, many investors thought that it would continue to ease every month. However, the actual path has been bumpier. Fed officials have warned that the inflation battle will be difficult, with both ups and downs along the way. Generally, aggressive policy tightening impacts financial markets.

Mortgage activity, which was recently at the lowest levels in 25 years, has picked up a bit lately. According to the latest data from the Mortgage Bankers Association (MBA), purchase applications rose modestly from last week. Though they are still down 35% from last year at this time. Applications to refinance increased 5% from the prior week, but remain down a massive 61% from one year ago.

Looking Ahead To The Employment Report

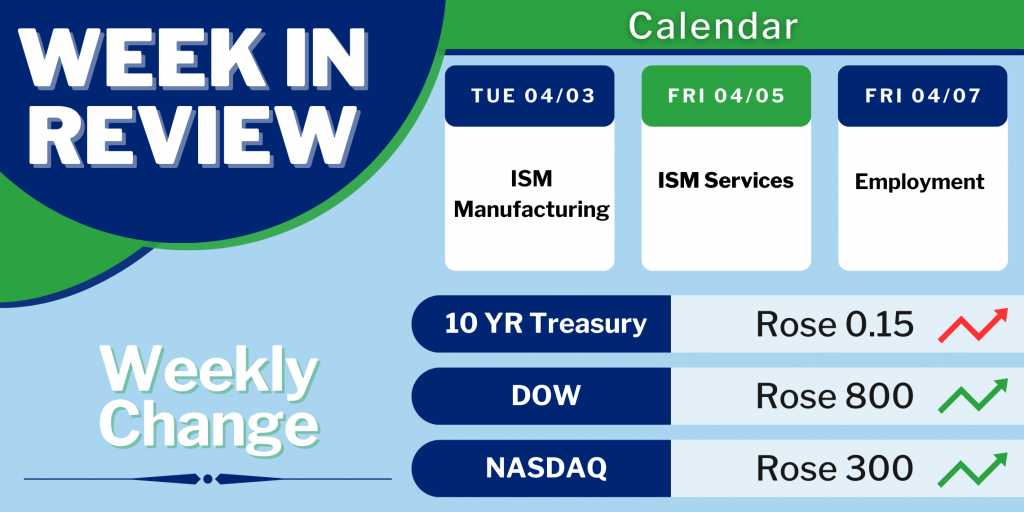

Investors will continue to keep a close eye on the banking sector to see if troubles spread to other institutions. They will also monitor to see if Fed officials elaborate on their plans for future monetary policy. The key Employment report releases on Friday.

These figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated economic data of the month. In addition, the ISM national manufacturing sector index will come out on Monday and the ISM national services sector index on Wednesday.

To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.