This week saw the release of the highly anticipated August 2022 Employment data. Overall, the report displayed mixed results for the labor market.

Meanwhile, investors grow increasingly concerned regarding stubbornly high inflation levels. Furthermore, the global central banks put investors on edge with their aggressive responses.

Conclusively, the major economic reports presented a neutral tone. As a result, mortgage rates ended the week higher.

August 2022 Employment Data Shows Growth in Professional and Business Sectors

Today, the closely watched August 2022 Employment data revealed mixed results. Against a consensus forecast of 320,000, the economy gained 315,000 jobs in August 2022. However, prior months saw lower revisions by 107,000.

Holistically, the professional and business services sectors performed the best. Healthcare and retail closely followed them. Surprisingly, after several strong months, the leisure and hospitality sectors came in relatively weaker.

Higher Unemployment and Average Hourly Earnings Overshadowed by Job Opening Ratio

Additionally, the August 2022 Employment data displayed higher unemployment and average hourly earnings figures. First, the unemployment rate unexpectedly increased from 3.5% to 3.7%. that said, analysts attribute the increase to a large number of people entering the labor force, a sign of strength.

Second, average hourly earnings, climbed 5.2% higher than a year ago. While average hourly earnings indicate wage growth, the latest report fell slightly below expectations.

In a separate report released on Tuesday, job openings remained above 11 million, near record levels. More so, job openings hover above 4 million more than in January 2020. Now, the economy sports approximately two vacant jobs for every unemployed worker.

Institute of Supply Management Reveals Steady Manufacturing Sector

Aside from the August 2022 Employment data, the Institute of Supply Management published the latest National Manufacturing Sector Index. With the release of this significant economic indicator, the ISM told the story of a steady manufacturing sector. Moreover, prices paid for materials posted a welcome decline.

The national manufacturing sector index stayed unchanged at 52.8. thus, the index presented a slightly stronger performance than expected.

Levels above 50 indicate that the sector is expanding. The prices paid index fell sharply for the second straight month to the lowest level since June 2020.

Looking Ahead After August 2022 Employment Data

After the release of the August 2022 Employment data, investors hope for specific Federal Reserve guidance. Notably, investors seek insight on the pace of future federal funds rate hikes. Also, investors want more clarity on the Federal Reserve’s bond portfolio reduction strategy.

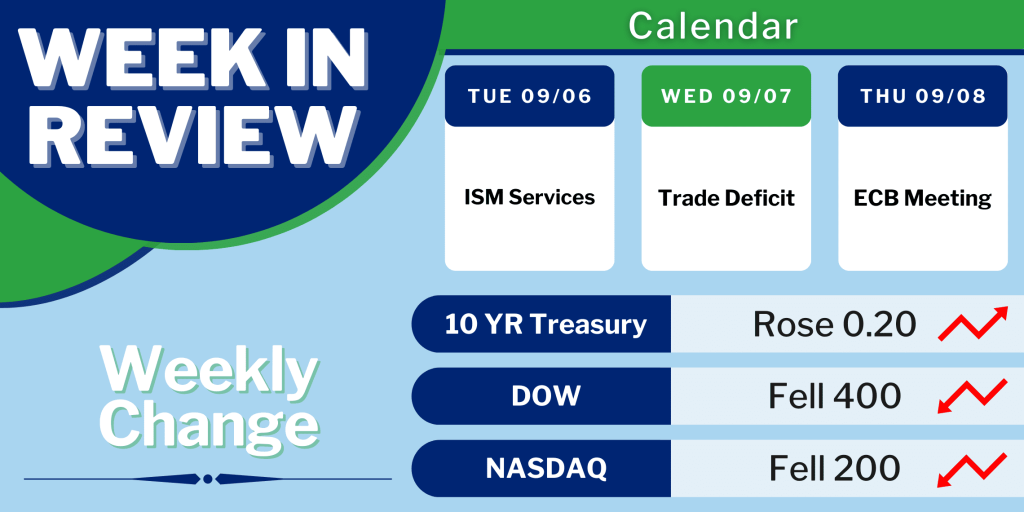

Next week, the European Central Bank (ECB) meets on Thursday. Currently, the ECB is dealing with record inflation levels.

Despite the big meeting, next week contains light economic reporting. Tuesday’s ISM Services Sector Index marks the biggest report of the week. Mortgage markets close on Monday in observance of Labor Day.

With the August 2022 Employment data, mortgage rates ended the week higher. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.