In a relatively quiet week for mortgage markets, investors saw steady job gains in the leisure and hospitality sectors. Overall, the key labor market report fell in line with expectations overall. Thus, mortgage rates ended the week a little higher.

Steady Job Gains

The closely watched Employment report released on Friday contained no major surprises. Against a consensus forecast of 325,000, the economy experienced steady job gains. Statistically, May’s data revealed gained 390,000 new jobs.

The leisure and hospitality sectors displayed particular strength, gaining 84,000 jobs. Conversely, the retail sector lost 61,000 jobs. Despite another month of solid gains, the economy still has slightly fewer total jobs than in early 2020 prior to the pandemic.

Labor Market Remains Extremely Tight

Similar to the steady job gains, the unemployment rate also maintained roughly the same pace at 3.6%. This number hovers just above the lowest level since 1969. Average hourly earnings, an indicator of wage growth, rose an impressive 5.2% higher than a year ago. However, average hourly earnings declined from an even larger annual rate of increase of 5.5% last month.

In a separate report released on Wednesday, job openings remained near record levels above 11 million. As a matter of fact, this is over 4 million more than in January 2020. In short, the labor market remains extremely tight.

ISM Indicates Expanding Manufacturing and Service Sectors

Aside from the steady job gains seen in the Employment report, the Institute of Supply Management (ISM) released their National Services Sector and Manufacturing Sector Indexes. Conclusively, both remained at high levels by historical standards.

The national services sector index came in at 55.9. Meanwhile, the national manufacturing index at 56.1. Levels above 50 indicate that the sectors are expanding. Investors watch to see if consumers will shift to purchasing more services and fewer goods in coming months.

Looking Ahead After Steady Job Gains

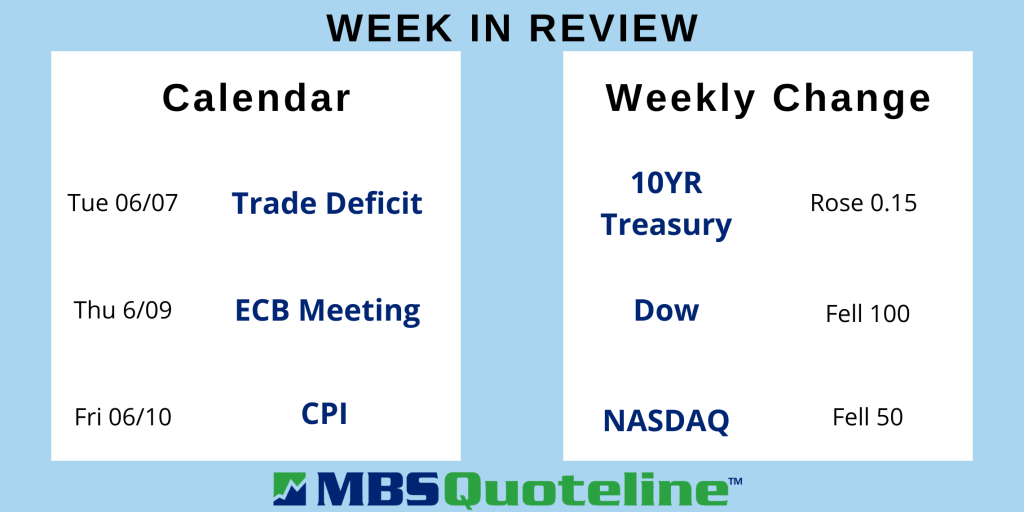

Looking ahead after the steady job gains, investors closely follow news on Ukraine and COVID-19 case counts in China. Also, investors look for additional Fed guidance on the pace of future rate hikes and bond portfolio reduction.

Beyond that, the next European Central Bank meeting takes place on Thursday. Capping off the week, the Consumer Price Index (CPI) releases on Friday. Investors widely follow CPI as a monthly inflation indicator. CPI looks at the price changes for a broad range of goods and services.

While job gains held steady, mortgage rates rose at the end of the week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.