As inflation moderates, investors focus on new consumer price index (CPI) findings. During a light week, they looked towards the CPI inflation report for guidance. While the results, roughly fell in line with expected levels, mortgage rates ended the week with little change.

Inflation Moderates

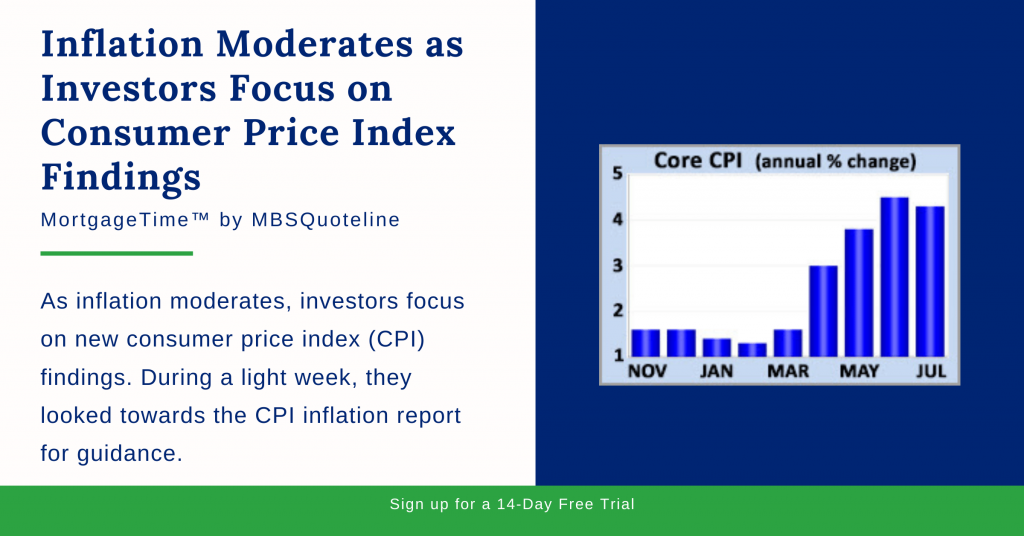

Investors view the core Consumer Price Index (CPI) as an inflation indicator. CPI excludes the volatile food and energy components.

In July 2021, core CPI rose just 0.3% from June. Statistically, core CPI plummeted from a massive increase of 0.9% last month. As inflation moderates, price gains evened out for many items, such as used cars.

Overall, core CPI rose 4.3% higher from a year prior. Ultimately, core CPI declined from an annual rate of increase of 4.5% last month, a level not seen since 1991, leading to fascinating core consumer price index findings.

Thoughts from the Fed as Inflation Moderates

While inflation remains high by historical standards, the Fed focused on the previous month as inflation moderates. Fed Chair Powell repeatedly said he believes that higher inflation has mostly been the result of disruptions caused by the pandemic and will be “transitory.” Also, Fed Chair Powell feels that inflation will return to more normal levels as the economy recovers.

If the downward trend continues, it lends support to his view. Additionally, the Fed will maintain the timing of their expected policy tightening. On the other hand, if Powell is incorrect and inflation remains elevated, the Fed might decide to tighten sooner. Since inflation is negative for bonds, the outcome largely influences mortgage rates.

JOLTS Report Indicates Tight Labor Market

As inflation moderates, the latest JOLTS report released. Generally speaking, JOLTS measures job openings and labor turnover rates. The latest JOLTS data indicates that the labor market is extremely tight.

At the end of June 2021, job openings unexpectedly surged to 10.1 million. The job openings shattered the former record high. Openings jumped three million higher than they were in January 2020, prior to the pandemic.

A high level of job openings reflects a strong labor market. However, companies struggle to hire enough workers with the necessary skills. Also, a large number of employees willingly left their jobs in June. Typically, people quit when they expect to find better jobs. Thus, analysts view this as a sign of labor market strength as well.

Looking Ahead After Inflation Moderates

Looking ahead after inflation moderates, investors watch global COVID-19 case counts. They also look for hints from Fed officials about the timing for changes in monetary policy.

Beyond that, Retail Sales release on Tuesday. Consumer spending accounts for over two-thirds of U.S. economic activity. Therefore, the retail sales data indicates economic growth. Finally, Housing Starts will come out on Wednesday.

Want to see how mortgage-backed securities are affected when inflation moderates? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.