Investors focused on surging inflation this week. Recently inflation data exceeded expectations. However, the Fed soothed investor concerns via their comments on the subject. In conclusion, mortgage rates ended the week nearly unchanged.

Investors Focused on Surging Inflation

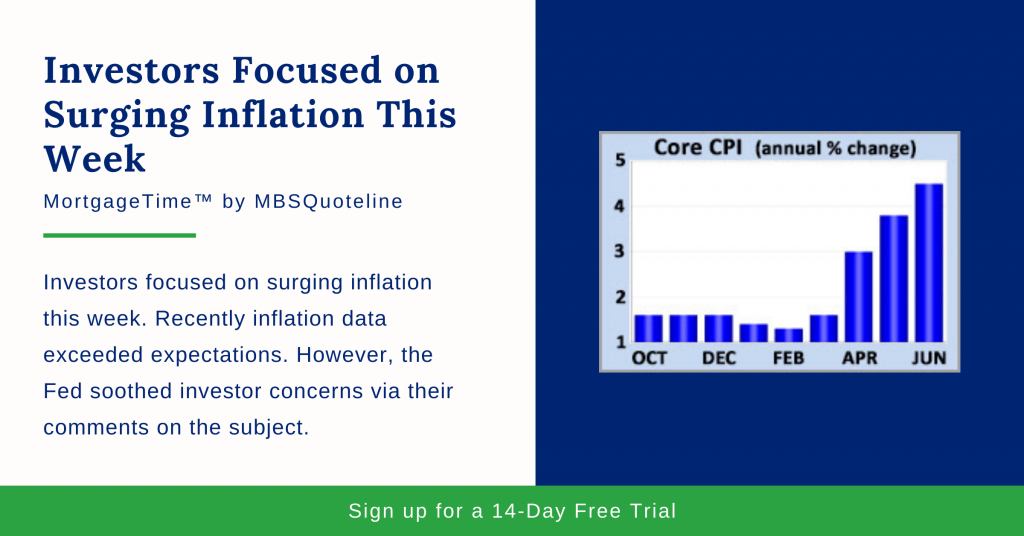

Analysts closely watch the Core Consumer Price Index (core CPI) In June. Core CPI indicates inflation while excluding volatile food and energy components.

In June 2021, investors focused on surging inflation as Core CPI jumped 0.9% from May 2019. This statistic leapt above the consensus forecast for an increase of just 0.5%.

The coronavirus notoriously affected prices across industries through last year. With the increase in Core CPI, analysts saw particularly large price in items, such as cars and airline tickets.

Subsequently, Core CPI rose 4.5% higher than a year ago. Not only is this result up from an annual rate of increase of just 1.6% in March, the current Core CPI reached its highest level since 1991.

Fed Response to Investors Focused on Surging Inflation

As investors focused on surging inflation, the Fed responded accordingly. During his semiannual testimony to Congress, Fed Chair Powell suggested that it was too soon to begin to tighten monetary policy. Fed Chair Powell also mentioned that achieving sufficient progress toward full employment was still “a ways off.“

Powell acknowledged that inflation has climbed substantially and “will likely remain elevated” in coming months. However, Powell expects inflation to moderate over time as imbalances caused by the pandemic ease.

Investors viewed Powell’s patient attitude toward inflation as an indication that the Fed is not in a hurry to scale back its bond purchase program. Concurrently, this represents good news for mortgage rates.

Retail Sales Continue Upward Trajectory

Consumer spending accounts for over two-thirds of U.S. economic activity. Because of this, the retail sales data is a key indicator of growth.

In June 2021, retail sales rose 0.6% from May 2021. Similar to Core CPI, retail sales far exceeded the consensus forecast. Having said that, retail sales did see an overall moderate decline.

Looking back to 2020, 2021’s retail sales data notched a whopping 18% higher than a year prior. In addition, retail sales also rose above levels seen prior to the coronavirus pandemic. In light of current conditions, analysts view the strong retail sales results even more impressively.

First, the auto industry is facing a shortage of chips and other components. This led to fewer new vehicles, holding back auto sales. Secondly, consumers recently shifted their spending from goods to services. Retail sales generally encompass “goods”, whereas travel and entertainment fall under “services”.

Looking Ahead After Investors Focused on Surging Inflation

Looking ahead after investors focused on surging inflation, investors watch COVID-19 case counts worldwide. Simultaneously, investors search for hints s from Fed officials about the timing for changes in monetary policy.

Beyond that, we are facing a noticeably light week for economic reports with an emphasis on the housing market. Housing Starts release on Tuesday. Existing Home Sales come out on Thursday.

Want to see how mortgage-backed securities are affected while investors focused on surging inflation? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.