This week, stocks plunged amidst the latest concerns regarding the coronavirus pandemic. Overall, investors shifted their assets to less risky assets. With the emphasis surrounding the coronavirus, the economic data little reaction.

As a result, the stock market posted enormous losses. Unbelievably, mortgage rates reached the lowest levels in years.

Stocks Plunge Amidst Latest Coronavirus Concerns

Stocks plunged amidst the latest coronavirus concerns. COVID-19’s holds a pretty straightforward impact on mortgage rates. Because people scaled back their activities, global economic activity screeched to a halt. Additionally, the inflation outlook decline.

Since no one knows how much more the disease will spread, it is still extremely difficult to forecast the extent of its economic impact. In response to the uncertainty, investors continued to reduce the level of risk in their portfolios. This shift generated a favorable impact for mortgage-backed securities (MBS).

Inflation Holds at Low Levels as Stocks Plunge Amidst Latest Coronavirus Concerns

As stocks plunge amidst coronavirus concerns, inflation holds steady at low levels. Even prior to the pandemic, January’s core PCE Price Index rose just 1.6% compared to the prior year.

The Federal Reserve favors Core PCE as its go-to inflation indicator. That said, Fed officials stated that they would like to see it rise to an annual rate of 2.0%. Low current inflation and the uncertain economic impact of the disease significantly raised investor expectations for the Fed to cut rates as soon as the next meeting on March 18th.

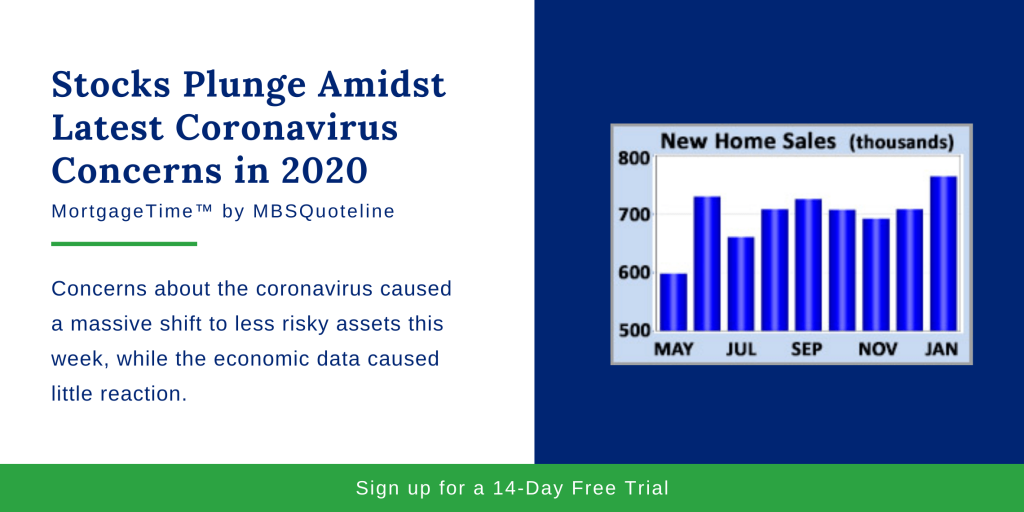

Housing Sector Offers Rare Source of Good News

In a bleak weak, the housing sector offered a rare source of good news. Helped by the substantial decline in mortgage rates as stocks plunged, sales of new homes in January rose far more than expected to the highest level since 2007. Since new home sales measure contracts signed, analysts view them as the most current indicator of housing market activity.

Looking Ahead After Stocks Plunge Amidst Coronavirus Concerns

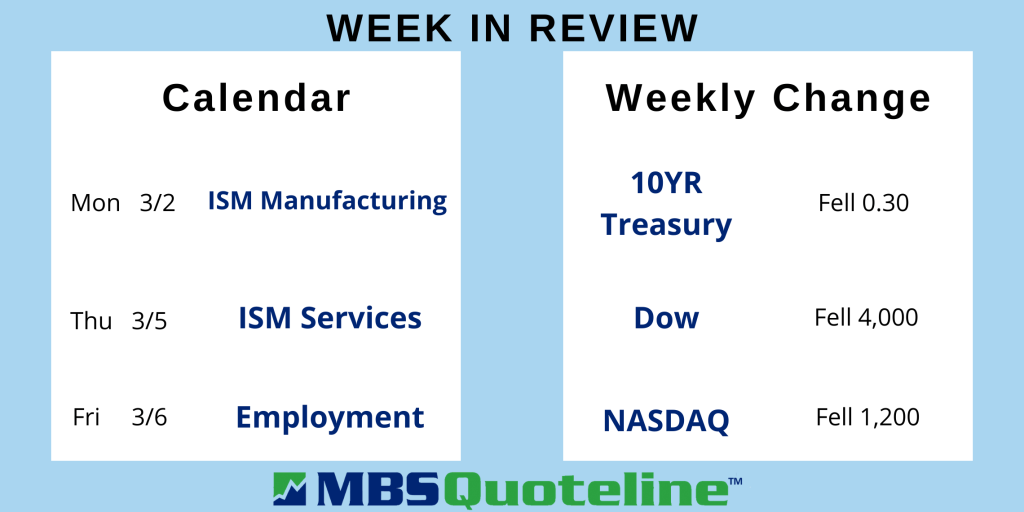

After stocks plunged amidst the latest coronavirus concerns, investors remain fixated on the pandemic. Meanwhile, the monthly Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation indicate the most highly anticipated economic data of the month.

Before that, the ISM national manufacturing index comes out on Monday. Additionally, the ISM national services index publishes on Thursday. In addition, news about the United States elections may hold influence over mortgage-backed securities.

As the stock market plunges amidst the latest coronavirus concerns, mortgage rates hover around record lows. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.