Mortgage rates saw little change after mixed economic data this week. Currently, investors look ahead to the major central bank meetings later in the month. With the mixed results, it created a small net effect on mortgage-backed securities.

Employment Report Highlights Mixed Economic Data This Week

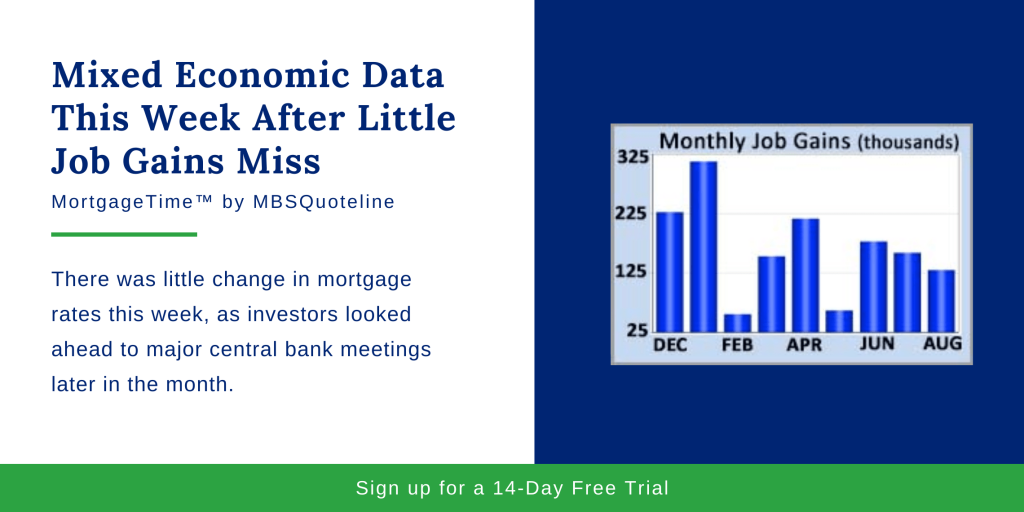

Kicking off the mixed economic data from this week, job gains saw a small miss in Friday’s key Employment report. However, wage gains surpassed expectations, offsetting the job gains miss.

Against a consensus forecast of 150,000, the economy added just 130,000 jobs in August. In addition, downward revisions subtracted 20,000 jobs from the results for prior months. As expected, the Unemployment Rate remained at 3.7%. Average hourly earnings, an indicator of wage growth, rose 0.4% from July, above the consensus of 0.3%.

Economy Reflects Mixed Economic Data This Week

Earlier in the week, the major data again reflected mixed economic data this week as the majority of the economy revealed a solid performance. That said, the manufacturing sector presented a glaring exception to that statement.

The ISM national services index posted much larger than expected gains to 56.4, but the ISM national manufacturing index missed to the downside with a decline to 49.1. Readings above 50 indicate an expansion, while readings below 50 indicate a contraction. Global manufacturing activity slowed in recent months by increased trade barriers such as tariffs.

Trade Negotiations Show Willingness to Reach a Deal

Aside from the mixed economic data this week, the trade front demonstrates plenty of optimism. Overall, the United States and China indicated a willingness on both sides to continue to work toward a mutually beneficial deal.

On Thursday, officials announced that the next round of trade talks take place early in October.

Looking Ahead After Mixed Economic Data This Week

After this week’s mixed economic data, the next European Central Bank (ECB) meeting takes place on Thursday. In the United States, the Consumer Price Index (CPI) comes out on Thursday. Investors widely follow CPI because it looks at the price change for goods and services.

Retail Sales release on Friday. Since consumer spending accounts for about 70% of all economic activity in the United States, the retail sales data indicates growth potential. The next U.S. Fed meeting takes place on September 18th. In addition, news about the trade negotiations could influence mortgage rates.

After the mixed economic data this week, mortgage rates barely changed. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.