August ended quieted as trade tensions eased this week. In the last week of the month, mortgage rates remained relatively stable. While investors concentrated on the the latest news on the trade negotiations between the U.S. and China, it created little lasting impact.

Additionally, the latest economic reports generated a minor impact. Since the end of July, mortgage rates posted very significant declines.

Trade Tensions Ease This Week

After long-term conflict, investors received good news as trade tensions eased this week. Following a series of threatened tariff increases by one country and retaliatory moves by the other earlier in the month, the U.S. and China expressed willingness to collaborate on reaching a mutually beneficial deal.

For example, Chinese trade officials said that they “firmly reject an escalation” of the trade war. Also, Chinese trade officials hope to continue negotiations with a “calm attitude.”

Inflation Holds Steady as Trade Tensions Ease This Week

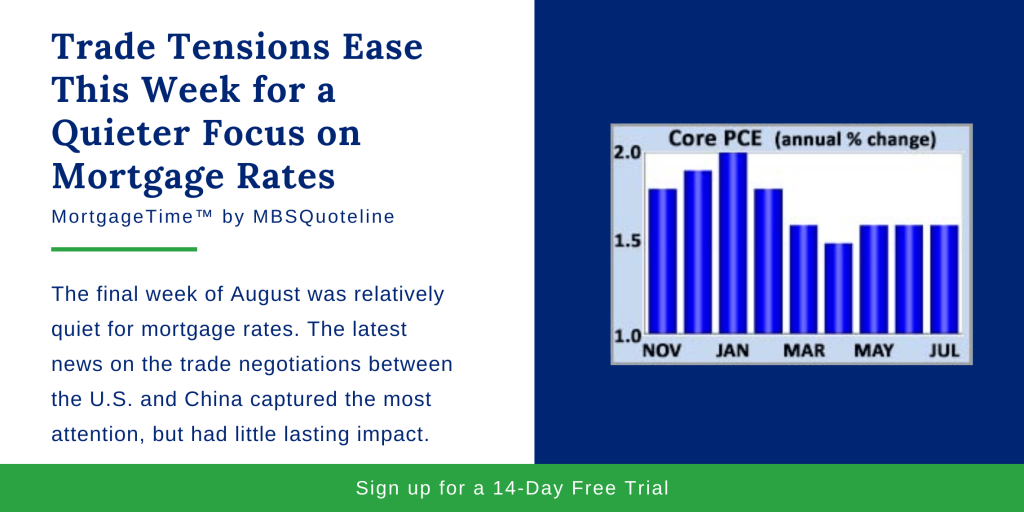

As trade tensions eased this week, inflation held stead at low levels. In July, the core PCE price index, the inflation indicator favored by the Fed, rose just 1.6% higher than a year ago.

In doing so, Core PCE achieved the same annual rate of increase as last month. Currently, the Federal Reserve stated that its target holds at 2.0%. However, July marked the fifth straight month of readings well below this level.

Pending Home Sales Fell

While the U.S. faced optimistic news when trade tensions eased this week, the housing sector data proved mildly disappointing. In July, pending home sales fell 2.5% from June. In addition, the consensus forecast anticipated a much smaller decline.

Since pending sales represent signed contracts to buy existing homes, they indicate future real estate closings in the coming months. Even with the decline in July, though, pending sales maintained roughly the same level as a year ago.

Looking Ahead as Trade Tensions Ease This Week

Looking ahead, mortgage markets close on Monday in observance of Labor Day. Next, the ISM national manufacturing index comes out on Tuesday. Later, the ISM national services index publishes on Thursday. In addition, news about the trade negotiations holds influence over mortgage rates.

As trade tensions ease this week, the monthly Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated economic data of the month.

While trade tensions eased this week, mortgage rates didn’t see a rapid decline, but it’s still early. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.