This week, the latest data showed MBS prices rise as economic growth slowed down. First, the Federal Reserve’s aggressive monetary policy tightening took its toll. Second, the banking industry continues to face its share of challenges.

As a result, businesses tightened their belts. This led investors to reduce their future outlook. Thus, mortgage rates ended the week lower.

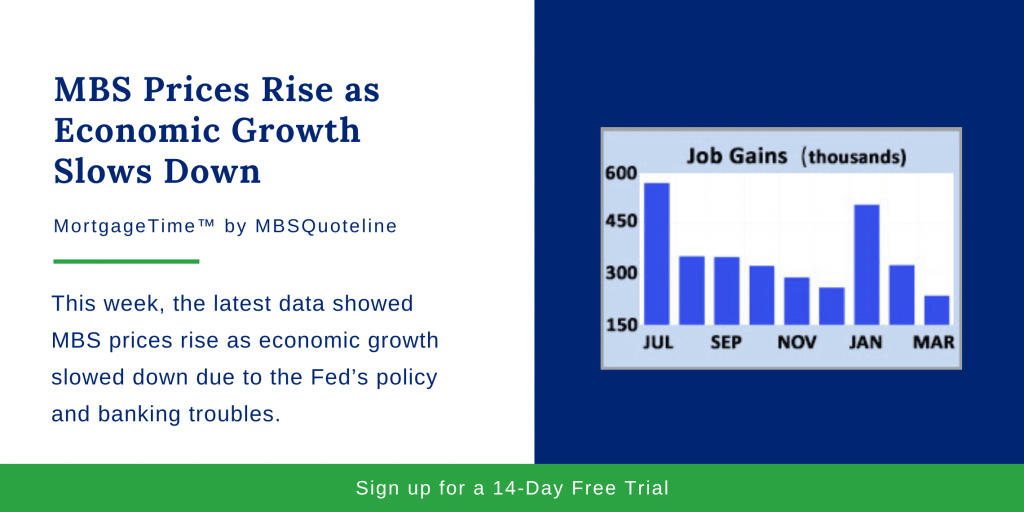

MBS Prices Rose Despite Loosening Labor Market

The latest Employment report revealed the expected easing of tightness in the labor market, contributing to the increase in MBS prices. After significantly larger gains over the prior two months, the economy added just 236,000 jobs in March. This came very close to the consensus forecast but the smallest monthly gain since December 2020. Average hourly earnings were 4.2% higher than a year ago, down sharply from 4.6% last month and the lowest annual rate of increase since June 2021.

The JOLTS (job openings and labor turnover rates) report remained very high by historical standards. However, it hinted at looser conditions in the labor market as well. At the end of February, there were 9.9 million job openings, over 3 million more than in January 2020 prior to the pandemic. However, this was far below the consensus forecast and the lowest level since April 2021. Since a lower number of openings means that there is less need for companies to raise wages in order to hire enough workers, this weaker than expected data was good news for mortgage rates.

Institute of Supply Management Hinted at Slowing Economic Growth

Further impacting MBS prices, the Institute of Supply Management showed weaker data than expected, hinting at slower economic growth. The ISM national services sector index fell to 51.2.

In addition, the ISM national manufacturing index dropped to 46.3, its lowest level since May 2020. Also positive for mortgage rates, the prices paid components of both reports declined sharply, a sign of decreased future inflationary pressures.

Looking Ahead After MBS Prices Rose

After MBS prices rose, investors continue to watch the banking sector for signs that troubles are spreading to other institutions. Also, investors hope for more news from the Federal Reserve on future monetary policy decisions.

Next week, the Consumer Price Index (CPI) releases on Wednesday. Investors and analysts see CPI as a monthly inflation indicator because it looks at the price changes for a broad range of goods and services. Later, Retail Sales come out on Friday. Consumer spending accounts for over two-thirds of the United States economic activity. Therefore, the retail sales data helps to measure economic health.

As MBS prices increased, mortgage rates declined by the week’s end. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.