This week, investors awaited the latest Fed guidance. With last month’s surprises from the Federal Reserve, Fed officials plan to reduce their bond portfolio more quickly than expected.

This news generated a negative impact for mortgage rates. Thus, mortgage rates rose to their highest levels since late 2018.

Fed Guidance Indicates Rapid Pace

To review, the Federal Reserve loosens monetary policy to boost the economy during periods of weakness such as after the start of the pandemic. By contrast, when the economy exceeds a certain capacity, the demand for goods and services becomes so strong that prices must rise to balance supply and demand, eventually forcing the Fed to tighten. The challenge is to implement the optimal level of tightening. This restrains economic growth just the right amount to bring down inflation without causing an undesirable recession (a soft landing).

Adjusting the federal funds rate and the size of the bond portfolio are the two primary tools used by the Fed to achieve its goals. Two weeks ago, the latest Fed guidance provided fairly precise insight on the projected pace of rate hikes. This week, they revealed their bond portfolio plans. In short, officials expressed more concern about upside risks to inflation than downside risks to economic growth.

Meeting Minutes Reveal Latest Fed Guidance

On Wednesday, March 16th’s Federal Reserve meeting minutes indicated that the Fed plans to allow its holdings of Treasuries and mortgage-backed securities (MBS) to decrease by up to $95 billion per month. Overall, this reveals a faster than anticipated pace, likely beginning in May. The split comes down to $60 billion in Treasuries and $35 billion in MBS, phased in over three months.

For months, investors awaited this Fed guidance. While these quantities are quite large on a historical basis, they must be viewed in the context of nine trillion dollars of total bond holdings, double the levels held prior to the pandemic. Since mortgage rates are largely based on MBS prices, the reduced outlook for Fed demand for mortgage-backed securities. Conclusively, mortgage rates moved higher.

ISM Shows Expanding Service Sector

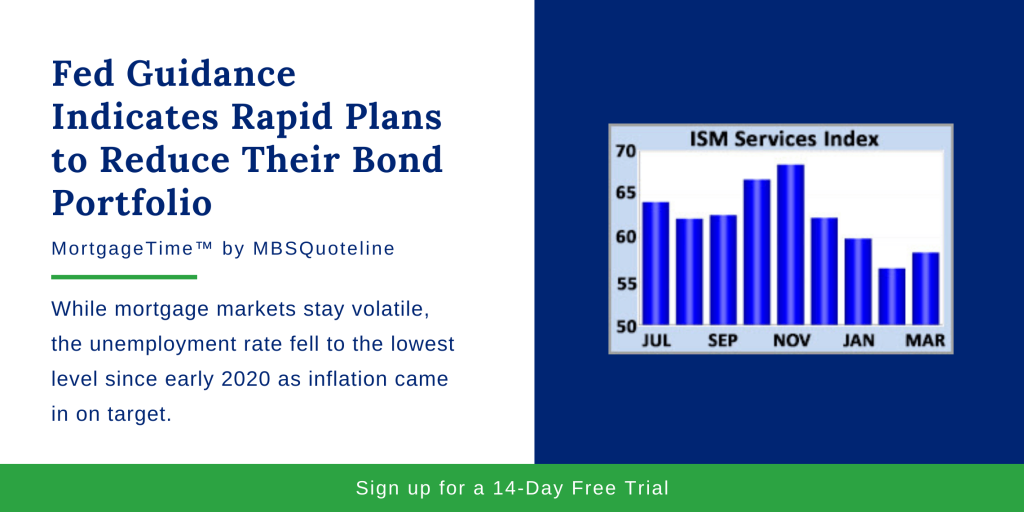

Aside from the Fed guidance, the most significant economic indicator released this week stemmed from the Institute of Supply Management (ISM). The latest data remained at a high level by historical standards. In fact, the national service sector index for March rose to 58.3.

Levels above 50 indicate that the sector is expanding. Readings above 60 are rare. Currently, investors watch to see how much consumer spending shifts from goods to services.

Looking Ahead After Most Recent Fed Guidance

After the most recent Fed guidance, investors look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Also, investors continue to closely follow news on Ukraine.

Beyond that, the Consumer Price Index (CPI) releases on Tuesday. Investors widely follow CPI because it looks at the price changes for a broad range of goods and services. Retail Sales come out on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data indicates growth.

With news of the latest Fed guidance, mortgage rates achieved late 2018 levels. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.