The first week of 2022 saw mortgage rates rise. While numerous analysts predicted them increasing throughout the year, this week’s reports pushed them to their highest levels since April 2021.

Meanwhile, investors pushed up bond yields due to inflation concerns. Finally, Wednesday’s Fed minutes indicated a hawkish report. The minutes indicated that the Federal Reserve remains in favor of tightening monetary policy. As a result, the United States sparked another round of bond selling.

Mortgage Rates Rise After Fed’s Purchase Program

Starting off the report, the United States faced a rise in mortgage rates. Early in the pandemic, the Federal Reserve initiated a new bond purchase program. They started this program to help stimulate the economy. Given the progress of the recovery and the rise in inflation, the Fed launched its process of winding down that program. Also, the Federal Reserve stayed on track to conclude it around the end of March.

With that in mind, investors sought guidance on the timing for additional tightening measures. Additionally, investors looked for insight into the timing of the federal funds rate increases. Lastly, investors hoped for information on the reduction in the Fed’s massive portfolio of bonds that built up on its balance sheet throughout the purchase program.

Fed Meeting Minutes Lead Mortgage Rates to Rise

The sooner-than-anticipated reduction in federal demand for mortgage-backed securities, the first week of the New Year saw mortgage rates rise. With Wednesday’s publication of the December 15th Federal Reserve meeting minutes, investors moved forward their expectations for these other tightening measures. Now, investors expect the first rate hike to take place shortly after the bond purchase program ends. Beyond that, investors anticipate two additional rate hikes prior to the end of 2022.

In addition, all Federal Reserve officials expressed support for a reduction in the enormous balance sheet holdings of Treasuries and mortgage-backed securities (MBS). The current plan intends for this reduction to occur “at some point” after the first rate hike.

Mixed Employment Report

While the real estate market saw mortgage rates rise, the closely watched Employment report came out on Friday. Revealing mixed results, the economy gained just 199,000 jobs in December against a consensus forecast of 420,000. However, revisions added 141,000 jobs to the figures for prior months. These revisions offset most of the shortfall. Overall, the gains took place in a wide range of industries, led by the leisure and hospitality sectors. Now, the U.S. economy holds roughly 3 million fewer jobs than in February 2020, prior to the start of the pandemic.

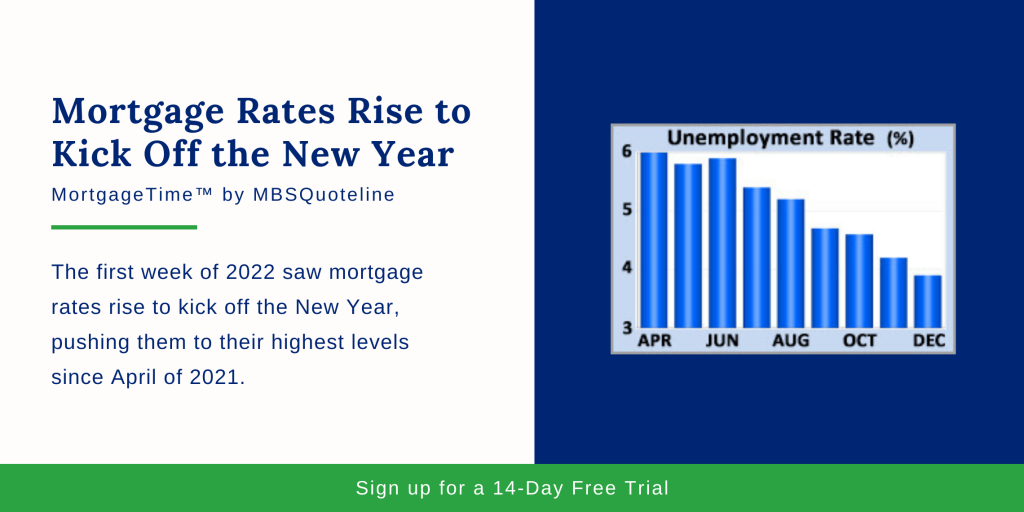

Aside from job gains, the rest of the report came out stronger than expected. The unemployment rate, which is based on a survey of individuals, declined from 4.2% to 3.9%. Thus, the unemployment rate fell below the consensus forecast of 4.1%. In doing so, the unemployment rate hit its lowest level since February 2020. Average hourly earnings, an indicator of wage growth, exceeded expectations. Concurrently, average hourly earnings climbed an impressive 4.7% higher than a year ago.

Strong Manufacturing News

With the mixed Employment report and strong manufacturing report, mortgage rates rose to start 2022. On the manufacturing front, the Institute of Supply Management (ISM) released a couple of significant economic reports this week. As expected, the National Services Sector Index and National Manufacturing Index remained at high levels. First, the Service Sector Index reached 67.6. Then, the National Manufacturing Index hit 58.7. Levels above just 50 indicate that the sectors are expanding. Also, readings above 60 are rare.

To date, supply chain issues still greatly impact manufacturing companies that produce goods. On the other hand, service-based companies, such as computer programming and banking, face less of an impact.

Looking Ahead After Mortgage Rates Rise

After the rise of mortgage rates, investors closely follow news on the Omicron variant. In addition, investors look for additional Fed guidance on the timing for future rate hikes and balance sheet reduction.

In terms of reporting, the Consumer Price Index (CPI) releases on Wednesday. Investors widely follow the monthly CPI report as an inflation indicator. CPI examines the price changes for a broad range of goods and services.

Closing out the week, Retail Sales comes out on Friday. Consumer spending accounts for over two-thirds of U.S. economic activity. Due to this, the retail sales data indicates growth levels.

While this week saw mortgage rates rise, mortgage-backed securities constantly fluctuate. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.