After months of back-and-forth discussion, last week saw inflation jump to a 30-year high as shortages compound. Overall, the stronger-than-expected inflation data reflected negatively against mortgage markets. As a result, mortgage rates ended the week higher.

Inflation Jumped to 30-Year High

This week’s breaking news occurred when inflation jumped to a 30-year high. Analysts and investors regularly watch the Consumer Price Index (CPI) for inflation indication. CPI represents closely looks at price changes for a broad range of goods and services.

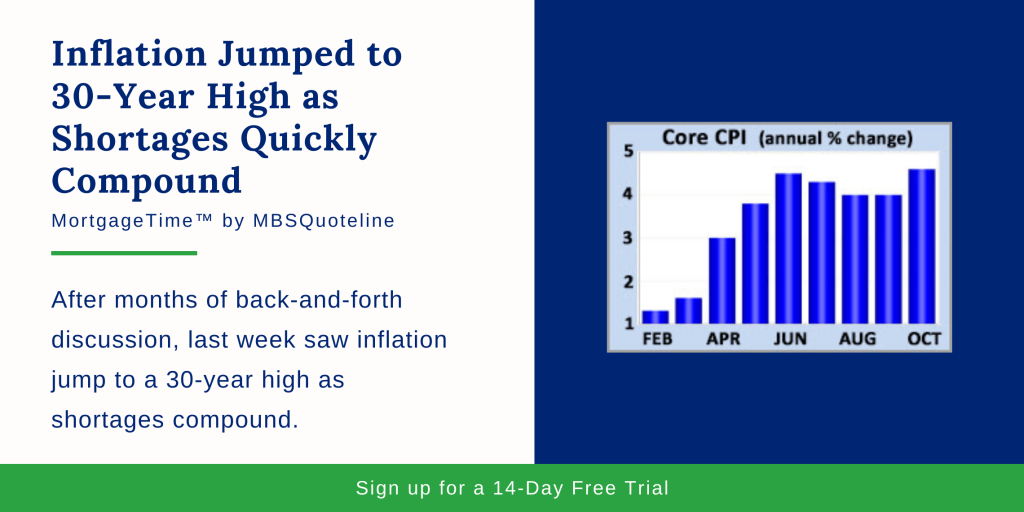

Meanwhile, core CPI excludes the volatile food and energy components. Additionally, Core CPI provides a clearer picture of the longer-term trend. In October, Core CPI rose 4.6% higher than a year ago. Core CPI jumped up from an annual rate of increase of 4.0% last month. Conclusively, core CPI hit its highest level since 1991.

Reasons Why Inflation Jumped to 30-Year High

When analyzing the inflation jump to a 30-year high, many reasons come up. Earlier in the year, inflation hovered below 2.0%, but quite a bit changed since the start of 2021. Currently, the United States economy faces a tight labor market, strong consumer demand for goods, rising energy prices, and supply chain disruptions.

In terms of economics, supply shortages fueled enormous cost increases. For instance, because of used cars, prices surged 26% higher than a year ago. Fed officials and economists still debate the long-term outlook of inflation. Some believe the recent inflation spike stems from temporary factors induced by the coronavirus pandemic. Others view the inflation activity as structural (long-lasting) in nature.

As the evidence piles up to support the latter case, investors pulled forward the expected timeline for Fed rate hikes. The first rate hike takes place around the middle of 2022.

JOLTS Indicates Tight Labor Market

Aside from inflation jumping to a 30-year high, the JOLTS report came out. JOLTS measures job openings and labor turnover rates. In general, the latest data indicated that the labor market remains very tight.

At the end of September 2021, the U.S. economy saw a massive 10.4 million job openings. This number neared the recent record high. Comparatively, job openings fall three million higher than they were in January 2020 prior to the pandemic.

Holistically, a high level of job openings reflects a strong labor market. Thus, companies struggle to hire enough workers with the necessary skills. A record high number of employees also willingly left their jobs in September 2021, dubbed “The Great Resignation”. This further amplifies signs of a strong labor market. Typically, people quit only if they expect that they can find better jobs.

Looking Ahead After Inflation Jumps to 30-Year High

Looking ahead after inflation jumped to a 30-year high, investors seek hints from Fed officials about the timing for future rate hikes. In addition, investors continue to closely watch COVID-19 case counts around the world.

Beyond that, Retail Sales release on Tuesday. Consumer spending accounts for over two-thirds of U.S. economic activity. Therefore, the retail sales data signifies a key indicator of growth. Housing Starts come out on Wednesday.

Want to see how inflation jumping to a 30-year high increased mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.