As expected, the latest European Central Bank announcement came out this week. After months, they finally announced the expected policy change in its bond purchase program.

Aside from that, there were not any additional economic surprises. As a result, rates ended the week with little change.

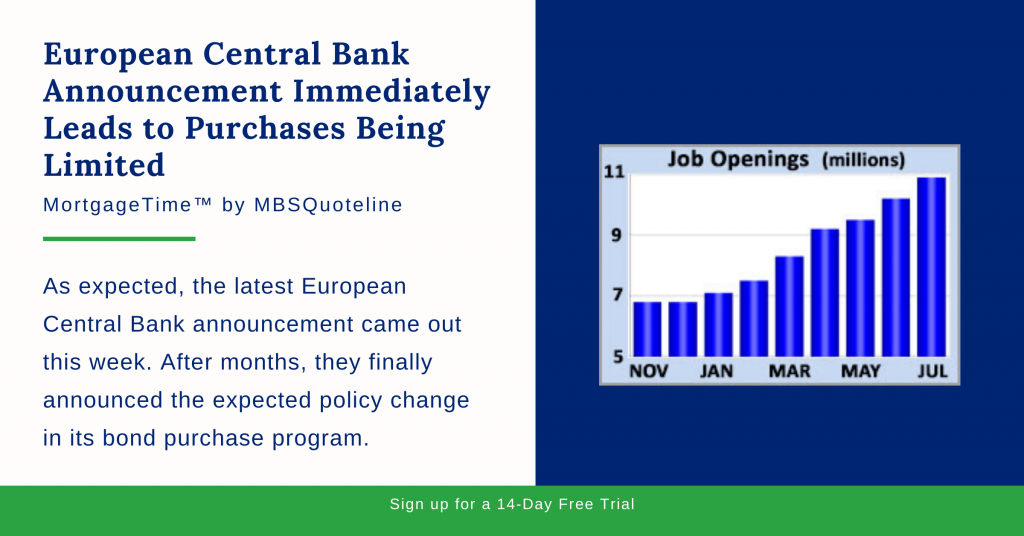

JOLTS Report Shows Record-High Job Openings

Prior to discussing the European Central Bank announcement, the latest JOLTS came out. For the unacquainted, the JOLTS report measures job openings and labor turnover rates. Conclusively, the latest data indicated that the labor market is extremely tight.

At the end of July 2021, job openings unexpectedly surged to 10.9 million. Thus, job openings shattered the former record high. Openings climbed well over three million higher than they were in January 2020 prior to the pandemic.

Overall, a high level of job openings reflects a strong labor market. This shows that companies struggle to hire enough workers with the necessary skills. Additionally, a large number of employees by historical standards also willingly left their jobs in July. Analysts also view this as a sign of labor market strength. Generally speaking, people quit only if they expect that they can find better jobs.

European Central Bank Announcement & Inflation

As expected, Thursday’s European Central Bank announcement showcased a reduction in bond purchases. That said, the European Central Bank did not specify the extent. Instead, the meeting statement said that it will proceed with a “moderately lower pace” of net asset purchases over the next three months. While the United States Fed has not tapered its bond-buying, analysts expect the Fed to do so prior to the end of 2021.

Meanwhile, Producer Price Index released last week as well. Producer Price Index (PPI) indicates inflation for raw material costs for items which are used by producers to make finished products. In August 2021, PPI rose 0.7% from July, close to the consensus forecast. Also, PPI rose 8.3% higher than a year ago. Finally, PPI leapt from an annual rate of increase of 7.8% last month, reaching the highest level since 2010. Disruptions to supply chains caused by the pandemic have pushed up prices for many items.

Looking Ahead After European Central Bank Announcement

Looking ahead after the European Central Bank announcement, investors watch global COVID-19 case counts. Subsequently, investors look for hints from Fed officials about the timing for changes in monetary policy.

Beyond that, the Consumer Price Index (CPI) releases on Tuesday. Analysts widely follow CPI as a monthly inflation indicator. CPI examines price changes for a broad range of goods and services.

Retail Sales comes out on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, retail sales data indicates growth.

Want to see how the European Central Bank announcement affects mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.