This past week saw few economic developments though housing inventory continues to really compromise home sales results. Overall, it was a quiet week for mortgage markets. Mortgage rates ended nearly unchanged.

Housing Inventory Impact on Existing Home Sales

The lack of housing inventory remains a major obstacle for the housing sector. April 2021 existing home sales unexpectedly fell 3% from March.

Despite the modest decline, sales still were 34% higher than a year ago. However, this data is somewhat misleading due to the partial shutdown of the economy at that time. In addition, existing home sales rose 11% higher than April 2019.

The median existing-home price jumped 19% from last year. As a result, the median existing-home price reached a record level of $341,600.

Housing Inventory Problem Persists

On a darker note, the number of homes for sale dropped 21% lower than a year ago. This represents just a 2.4-month supply nationally. For analysts, this metric falls well below the 6-month supply. Generally speaking, a 6-month supply represents a healthy balance between buyers and sellers.

Given the critical need for improved housing inventory, the report on housing starts released this week was a bit disappointing. In April 2021, housing starts fell 10% from March. Therefore, this result failed to meet expectations.

Concurrently, builders place the restrained construction pace on a few factors. Primarily, they focus on the rising prices and shortages for land, materials, and skilled labor.

Fed Updates on Monetary Policy

Aside from the housing inventory issue, the Fed is planning to make changes. As the economy gradually improves, analysts anticipate that the Fed will scale back monetary policy measures. Throughout the coronavirus pandemic, the Fed loosen monetary policy to help the recovery effort.

In the April 28th Fed meeting, investors wanted to know when the Fed would scale back its massive bond buying program. According to the minutes, some officials felt that if the economy continued to improve rapidly “it might be appropriate at some point in upcoming meetings to begin discussing a plan” for a reduction in bond purchases.

In conclusion, there is no precise timeframe, which many investors find disappointing.

Looking Ahead After the Housing Inventory News

Looking ahead after the housing inventory news, investors monitor global COVID-19 case counts and vaccine distribution.

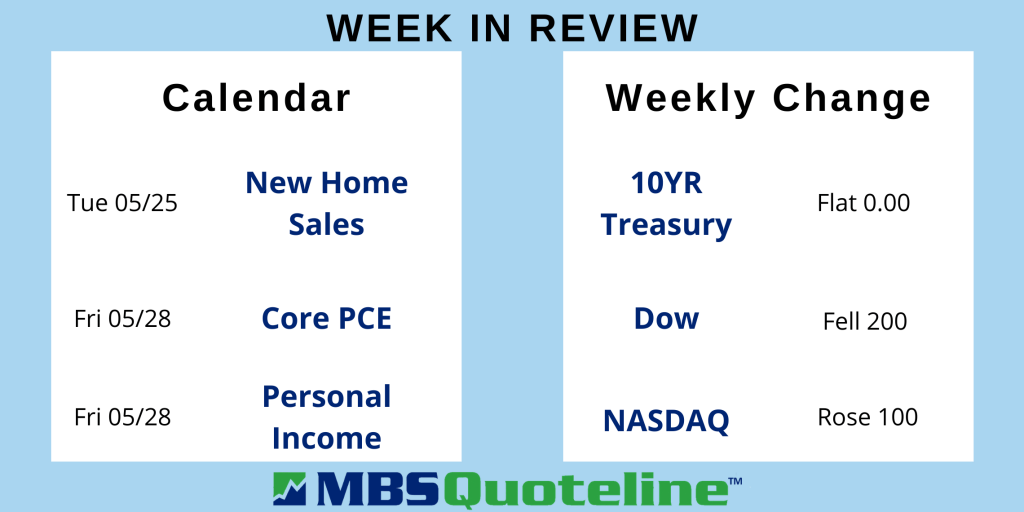

Beyond that, New Home Sales release on Tuesday. Pending Home Sales come out on Thursday.

Lastly, the core PCE price index, the inflation indicator favored by the Fed, releases on Friday.

Want to see how the lack of housing inventory impacts mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.