This week, the United States economy saw retail sales rise. However, they had a minimal reaction on mortgage rates. Additionally, stronger than expected inflation data and a new fee on refinances reflected negatively for mortgage rates. After reaching record-low levels last week, rates moved higher.

Retail Sales Rise as Consumer Spending Rebounds

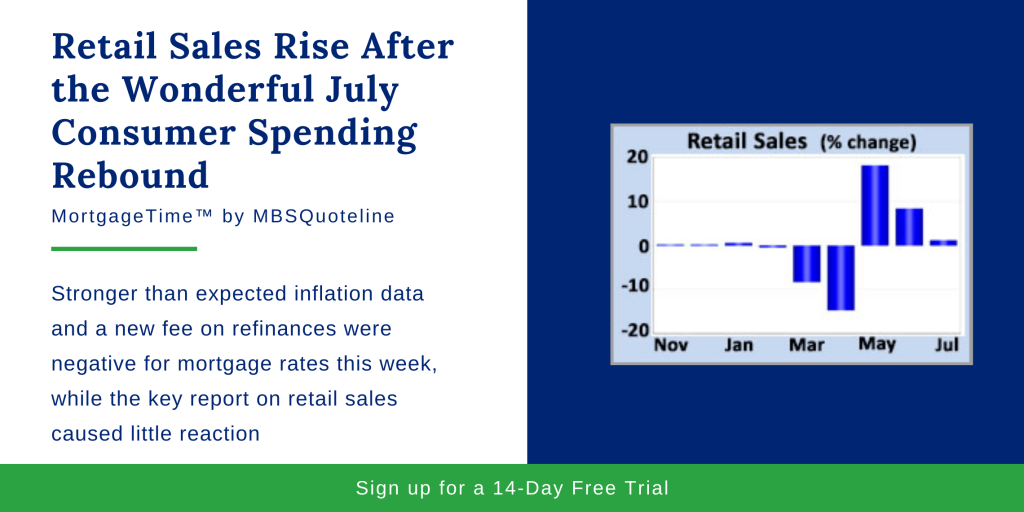

Due to the coronavirus, consumer spending dropped sharply in March and April in conjunction with the shutdown. However, July saw retail sales rise with an increase of 1.2%. In addition, analysts revised June results to be significantly higher. While retail strength distributed broadly, electronics, appliances, and health products demonstrated a good month.

Consumer Price Index Leads to Higher Inflation Forecast

As retail sales rise, investors also pay close attention to inflation. Although reduced economic activity initially caused an inflation decline, July’s core CPI came in 1.6% higher than a year ago. Despite this statistic being lower than the 2.0% seen prior to the pandemic, it still improved from the previous month’s 1.2%. Since higher inflation generates a negative effect for for mortgage rates, they rose after the news.

Federal Housing Finance Agency Announces Refinancing Fee

Aside from the CPI and retail sales rise, the Federal Housing Finance Agency (FHFA) announced a new refinance fee of 0.5% on Wednesday. The fee will be assessed for cash-out and no-cash-out refinances sold to Fannie Mae and Freddie Mac after September 1st. Lenders varied in how quickly they are passing along this fee to consumers. Overall, current refinancing pipelines and activity capacities dictate their decisions.

Looking Ahead After Retail Sales Rise

After retail sales rose, investors continue watching for news about medical advances, government stimulus programs, Fed monetary policy changes, and plans for reopening the economy. Beyond that, we’re looking at a very light week for economic data with the housing sector in the spotlight. Housing Starts release Tuesday and Existing Home Sales come out on Friday.

Following the rise in retail sales, mortgage rates hover at their highest point since the middle of 2019. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.