With Super Tuesday and the key monthly Employment report on the schedule, the world places focus on the coronavirus pandemic. While investors anticipated this would be a big week, no one foresaw that it would be overshadowed by the COVID-19 pandemic.

Once again, investors solely focused on the coronavirus pandemic. Thus, mortgage rates reached record low levels.

World Places Focus on Coronavirus Pandemic

As the world places focus on the coronavirus pandemic, mortgage rates continued their decline. Quite simply, global economic activity stalled, and the future inflation outlook declined. Overall, this news generated a favorable impact for mortgage-backed securities.

With high levels of uncertainty pervading everyday life, investors prefer relatively safer assets, such as bonds, to riskier assets, such as stocks.

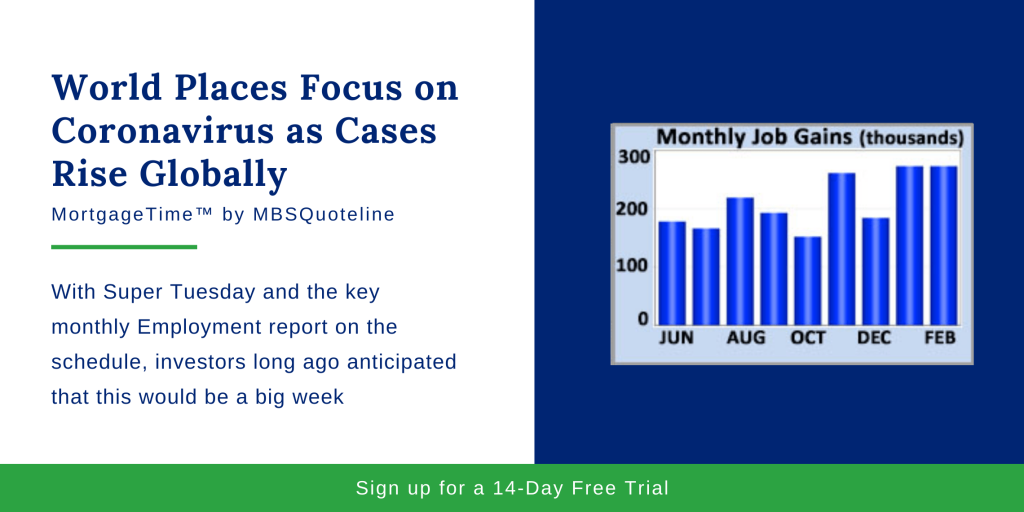

Employment Report Remains Unaffected by Pandemic

Despite the world placing focus on the pandemic, recent economic data showed the United States economy performed well beforehand. Friday’s labor market report highlighted this trend as the economy gained a massive 273,000 jobs in February against a consensus forecast of 175,000. Also, revisions added another 85,000 jobs to the results for prior months. Average job gains posted an enormous 243,000 over the past three months.

Meanwhile, the unemployment rate unexpectedly declined from 3.6% to 3.5%. Average hourly earnings, an indicator of wage growth, rose 3.0% higher than a year ago, matching expectations.

Looking Ahead After World Places Focus on Coronavirus Pandemic

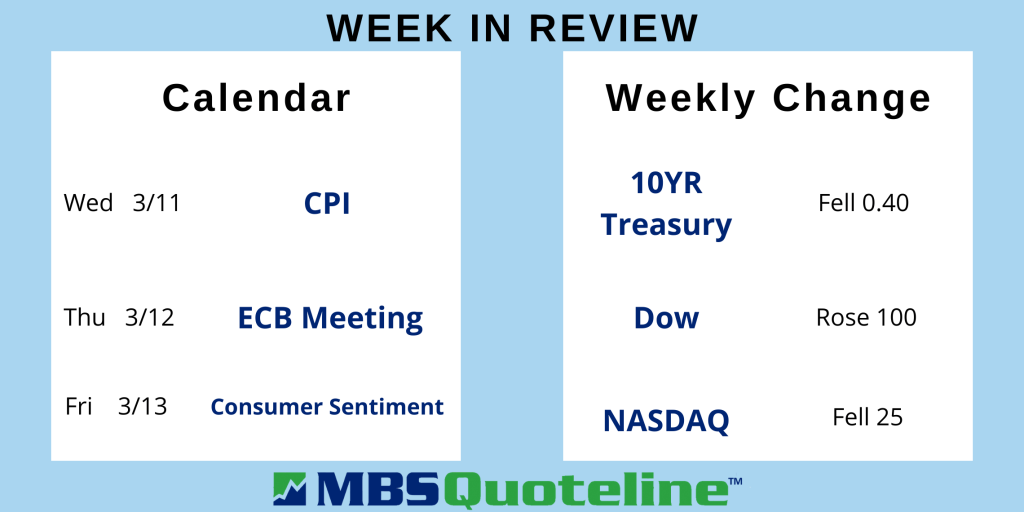

After the world placed focus on the coronavirus pandemic, investors remain focused on the virus. Beyond that, the Consumer Price Index (CPI) comes out on Wednesday. Investors follow CPI as a monthly inflation report that looks at the price change for goods and services.

The next European Central Bank (ECB) meeting takes place on Thursday. Investors expect the ECB to follow the lead of other global central banks by announcing additional stimulus measures. In addition, news about the US elections holds influence over mortgage-backed securities.

As the world places focus on the COVID-19 pandemic, mortgage rates plummeted further. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.