As the housing market shows new, encouraging data this week, it still faced overshadowing from Wednesday’s Fed meeting. However, the meeting produced no surprises and had little net effect. Overall, stronger than expected housing data created just a minor impact. Thus, mortgage rates ended the week a little lower.

Housing Market Shows New, Strong Reporting

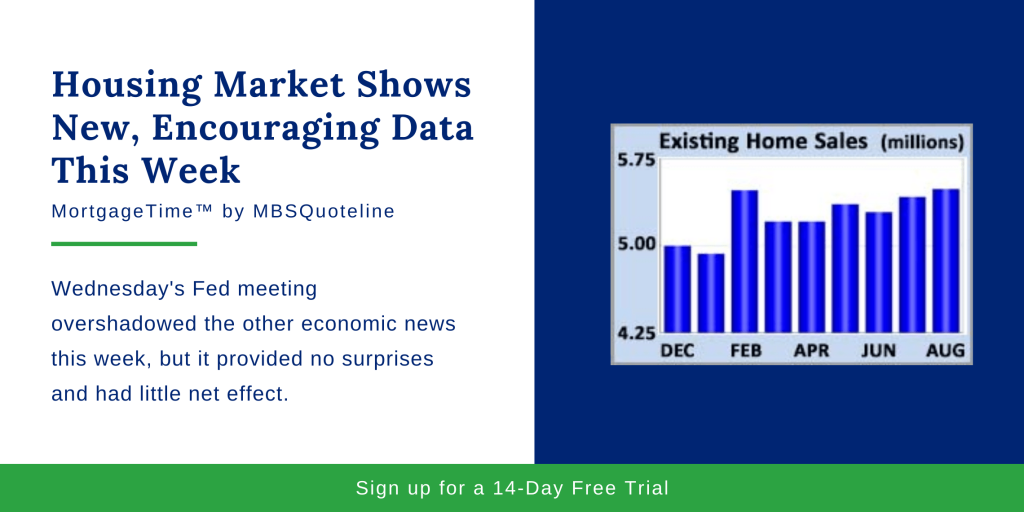

From a reporting standpoint, the big news came from the housing sector. As the housing market showed new data, sales of existing homes increased more than expected from July to August. Subsequently, existing home sales achieved their strongest level since March 2018 and rose modestly higher than a year ago. The national median existing-home price climbed up 5% from a year ago.

As always, many homes face a lack of inventory in many regions. This presents a barrier to stronger existing-home sales. Inventory levels nationally fell to just a 4.1-month supply, dropping 3% lower than a year ago.

However, additional home inventory may be on the way. In August, housing starts jumped 12% from July to the strongest level since June 2007. Both single-family and multi-family segments saw improvements. Starts increased 7% higher than a year ago. Similarly, building permits, a leading indicator of future construction, rose 8% from July to the best level since May 2007.

Federal Reserve Cutting Federal Funds Rate

While the housing market shows new, promising news, the Federal Reserve meeting met expectations. As expected, the Federal Reserve cut the federal funds rate by 25 basis points. Overall, Fed officials remain divided on the economic outlook.

While seven out of ten officials voted in favor of the cut, two preferred no change, and one supported a larger 50 basis point reduction. According to Fed Chair Powell, a number of potential risks made the forecast for U.S. growth more uncertain.

Most notably, global growth weakened. Simultaneously, trade tensions slowed manufacturing activity. Conclusively, the meeting provided little new information to cause investors to alter their outlook for future Fed policy.

Looking Ahead After Housing Market Shows New Data

After the housing market showed new data, New Home Sales come out on Wednesday. Also, Pending Home Sales publish on Thursday.

Finally, the core PCE price index, the inflation indicator favored by the Fed, and Durable Orders release on Friday. In addition, news about the trade negotiations holds influence over mortgage rates.

Despite the housing market showing new, encouraging data, mortgage rates ended the week lower. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.