This week, the Employment Report on Friday showed a healthy economy. Beyond that, investors also watched Wednesday’s Federal Reserve meeting. Because of the major economic news, mortgage markets experienced plenty of volatility.

However, the influences offset one another. Thus, mortgage rates ended the week nearly unchanged.

Employment Report on Friday Now Shows Healthy Economy

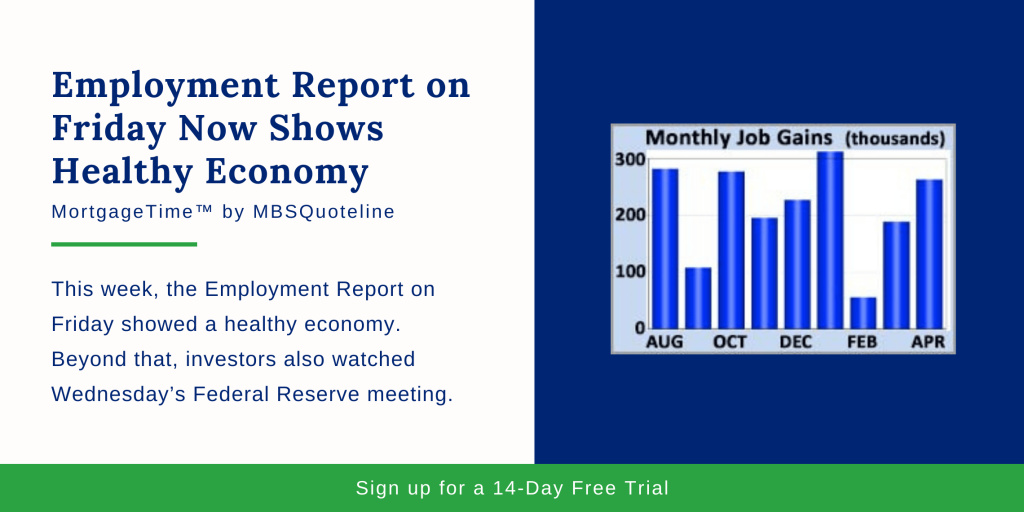

The Employment report on Friday now shows a healthy economy. Normally, stronger economic activity results in higher inflation due to increased demand for goods and services. However, the latest Employment report provided yet another clear example of the healthy economic growth with surprisingly tame inflation.

Against a consensus forecast of 190,000, the economy added 263,000 jobs in April. The unemployment rate unexpectedly declined from 3.8% to 3.6%. as a result, the unemployment rate reached its level since 1969. Wage inflation fell a little short of expectations, though. Meanwhile, average hourly earnings increased 3.2% higher than a year ago. At this pace, average hourly earnings maintain roughly the same annual rate of increase as last month. Despite the news, mortgage rates faced a small net effect.

Fed Didn’t Change Federal Funds Rate

Aside from the Employment report on Friday, the Fed made no change to the federal funds rate. After the meeting, the Fed noted “solid” gains in recent economic activity and job gains. However, the Fed also explicitly acknowledged that inflation has been running below the Fed’s target annual rate of 2.0%.

Ultimately, mortgage rates initially dropped as rate cut expectations rose due to this lack of inflationary pressures. Later, the declines reversed when Fed Chair Powell suggested during his press conference that low inflation appears to be mostly due to “transitory” rather than “persistent” factors. In addition, Fed Chair Powell said that officials “don’t see a strong case for moving” the federal funds rate “in either direction.”

Looking Ahead After the Employment Report on Friday

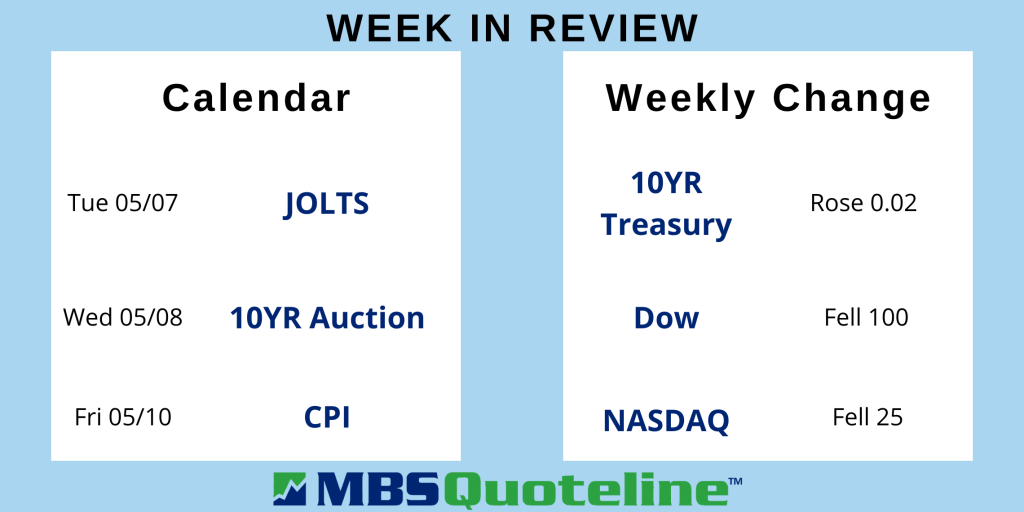

After the Employment report on Friday, investors look ahead to the next JOLTS report. JOLTS measures job openings and labor turnover rates. It releases on Tuesday. Fed officials value this data to help round out their view of the strength of the labor market.

Later in the week, the Consumer Price Index (CPI) comes out on Wednesday. Investors widely follow CPI as a monthly inflation report. CPI looks at the price change for goods and services.

In addition, Treasury auctions on Wednesday and Thursday hold influence over mortgage rates. Finally, investors watch for news about the trade negotiations between the U.S. and China.

Want to see how the Employment report on Friday impacts mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.