As analysts place focus on the Fed, mortgage rates ended the week higher. With the publication of the latest Federal Reserve minutes, mortgage rates fluctuated. Overall, mortgage rates faced a negative reaction. Aside from the minutes, the rest of the major economic data came out generally weaker than expected, leaving a minor impact.

Focus on the Fed Minutes

With the publication, analysts placed focus on the Fed minutes. While the September 26th meeting minutes contained no major surprises, investors viewed them as slightly more hawkish. Essentially, the Federal Reserve leaned towards tightening monetary policy.

Fed officials indicated that a gradual path of rate increases remains the appropriate policy given their projected pace of economic growth. However, the Fed officials surprised investors with their willingness to raise the federal funds rate above the “neutral” rate if needed.

The neutral rate reflects the level which the Fed estimates a balance between tight and loose monetary policy. Ideally, the neutral level neither boosts nor restrains economic growth in the long-term.

Tighter monetary policy generally is negative for mortgage rates. Thus, mortgage rates rose a little due to the minutes.

Retail & Housing Fell Short of Expectations

Beyond the focus on the Fed, this week saw the release of the latest retail sales and housing data. First, the retail sales data resulted in much worse information than anticipated. In September, total retail sales rose just 0.1% from August. This number dropped far below the consensus for an increase of 0.6%.

Excluding the volatile auto component, retail sales posted a slight decline from August. Additionally, this decline fell well short of the expected levels. Since the data often swings widely from month-to-month, the market had a small reaction.

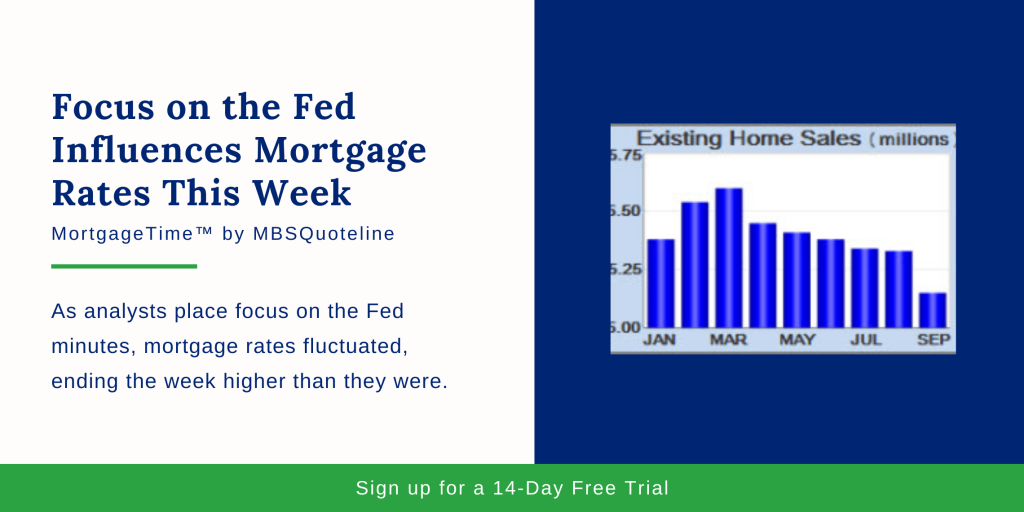

Meanwhile, the most recent housing sector data also fell short of expectations. In September, sales of previously owned homes fell 3% from August. Also, sales of existing homes declined 4% from a year ago. As has been the case for a while, the lack of housing inventory remains a major barrier to growth.

Housing starts in September were down 5% from August. One piece of relatively good news, however, was that most of the decline came from the multi-family segment. On the other hand, single-family starts declined just 1%.

Looking Ahead After Focus on the Fed

Looking ahead after the focus on the Fed minutes, New Home Sales release on Monday. Pending Home Sales and Durable Orders come out on Thursday.

The first reading for third quarter gross domestic product (GDP) publishes on Friday. As always, GDP represents the broadest measure of economic growth.

Finally, the next European Central Bank (ECB) meeting takes place on Thursday. This meeting might influence United States mortgage rates.

Want to see how the focus on the Fed impacts mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.