This week, a provocative selloff saw stocks fall suddenly. Additionally, the Dow Jones plummeted than 1,000 points. Normally, this reflects positively for mortgage rates. This time, mortgage rates faced a minor impact.

Beyond that, the United States saw weaker-than-expected inflation for a positive result. Therefore, mortgage rates ended the week slightly lower. However, mortgage rates hovered near their highest levels in many years.

Provocative Selloff Stocks Fall

It is common to see mortgage rates fall when the stock market declines, and vice-versa. However, this is not always the case. It depends on the reason for the movement.

Most of the time, the cause is shifting expectations for economic growth based on newly released data. Stronger growth is good for stocks. That said, stronger growth raises the outlook for future inflation. So, growth holds a negative reaction for mortgage rates. The reverse is true as well.

This week, a provocative selloff saw stocks drop, alongside the Dow Jones. A wide range of factors influenced financial markets. Most of these factors negatively impacted stocks. However, their expected impact on mortgage rates came out mixed, having a small net effect.

For example, tariffs generally are a drag on economic growth. Tariffs also raise prices, leading to higher future inflation. addition, the supply of bonds around the world increased as central banks reduced their holdings. Furthermore, the United States budget deficit grew due to boosted spending and tax cuts, forcing the government to issue more bonds. To summarize, higher inflation and greater supply roughly offset slower growth.

Inflation Failed to Meet September Expectations

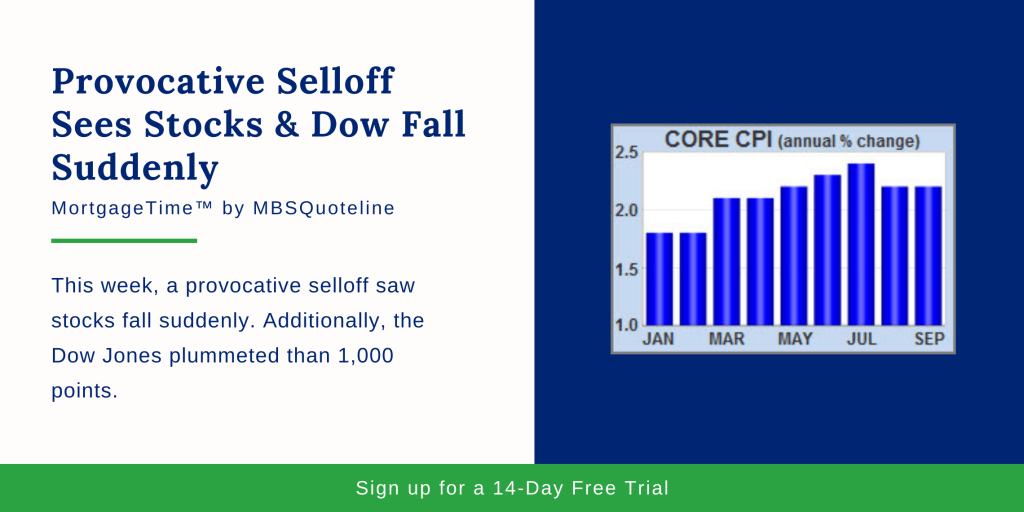

Aside from the provocative selloff seeing stocks drop, analysts closely watched for this week’s Consumer Price Index report. The Consumer Price Index (CPI) looks at the price change for finished goods and services. Thursday’s data revealed that inflation failed to meet September expectations.

Core CPI, which excludes the volatile food and energy components, rose 2.2% higher than a year ago. This means that Core CPI maintained the same annual rate of increase as the prior month. Since lower inflation displays positively for mortgage rates, this outcome spurned a slight decline.

Looking Ahead After Provocative Selloff Sees Stocks Fall

Looking ahead after the provocative selloff saw stocks fall, Retail Sales release on Monday. Consumer spending accounts for about 70% of all economic activity in the United States. Because of this, the retail sales data indicates growth.

Also, the minutes from the September 26th Federal Reserve meeting come out on Wednesday. These detailed minutes provide additional insight into the debate between Fed officials about future monetary policy. More so, the Fed meeting meetings hold the potential to move markets.

Finally, Housing Starts release on Wednesday. Home Sales publish on Friday.

Want to see how the market selloff impacts mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.