Amid growing concerns about the impact of high inflation, investors shifted their focus to the banking sector troubles and debt ceiling. This change in sentiment has led to an increase in mortgage rates, reversing the previous trend.

Furthermore, recent inflation data has surpassed expectations, contributing to the rise in rates. This week, MBSQuoteline explores the implications of high inflation on mortgage rates and the housing market, highlighting key economic indicators and investor sentiments.

Impact of High Inflation Pushes Mortgage Rates Higher

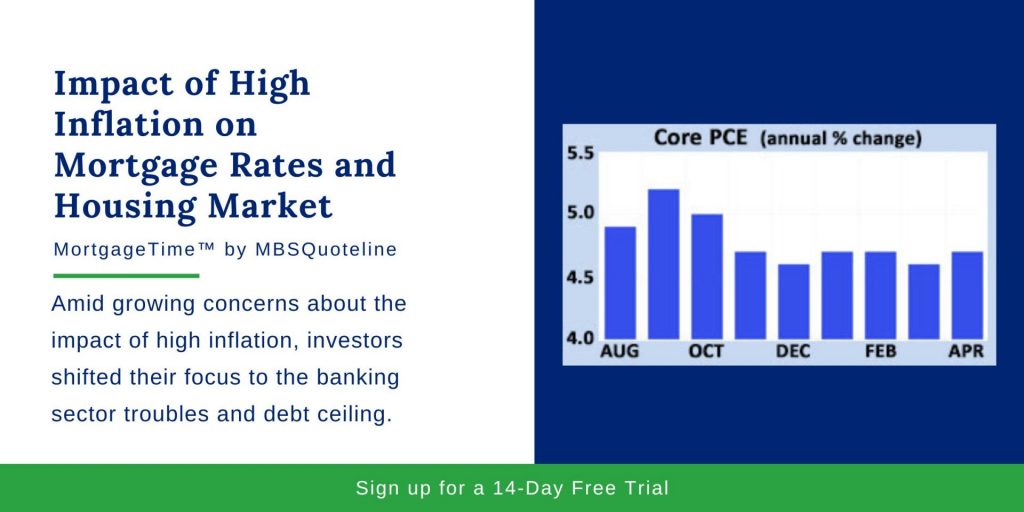

The preferred inflation indicator, the PCE price index, reveals a core inflation rate of 4.7% annually. Overall, this surpassed the Federal Reserve’s target level of 2.0%. This higher-than-anticipated inflation rate has played a role in driving mortgage rates to their highest levels since early March.

Investors closely monitor inflation trends as they impact the future course of monetary policy and financial markets.

Strong Demand for New Homes Amid Limited Inventory

Despite the challenges in the housing market, sales of new homes in April experienced a 4% increase compared to March. Thus, new home sales reached their highest level since March 2022.

This surge in demand can be attributed to the scarcity of previously owned homes available for sale. Many buyers have turned to the new home market, where the median price remains 8% lower than the previous year.

Fed’s Monetary Policy and Market Uncertainty

The recently released minutes from the May 3 Fed meeting shed little light on the future direction of monetary policy. Officials emphasized the need to retain flexibility in decision-making, given the evolving factors impacting the economy.

While some officials expressed concerns about the slow progress in reducing inflation, others highlighted the significant tightening already implemented and the time lag associated with its effects on the economy. Bank troubles and the debt ceiling talks have further contributed to market uncertainty.

Looking Beyond the Impact of High Inflation

As investors closely monitor the ongoing debt ceiling negotiations and banking sector troubles, the focus remains on future monetary policy decisions.

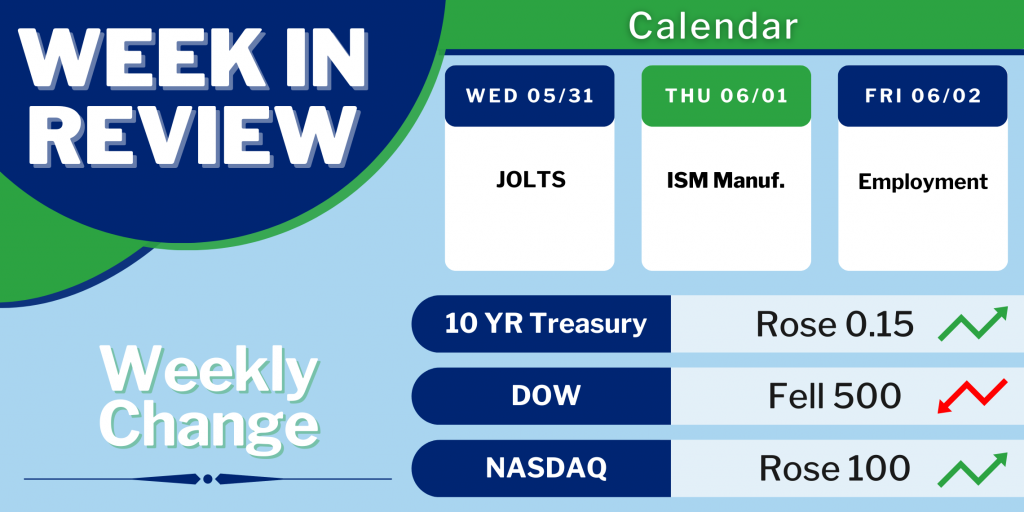

The upcoming economic reports, including the ISM national manufacturing index and the highly anticipated Employment report, will provide crucial insights into job growth, the unemployment rate, and wage inflation.

As markets react to the impact of high inflation, mortgage rates rose by week’s end. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.