With the release of last week’s Employment report, the United States reported unexpectedly strong job gains across the board. With this stronger than expected economic data, mortgage rates received an unfavorable reaction.

Overall, the key labor market report far exceeded the forecasts. Thus, mortgage rates ended the week higher.

Employment Report Reveals Unexpectedly Strong aJob Gains

Every month, the Employment report represents the most highly anticipated data. Withy Friday’s release, the data revealed unexpectedly strong job gains. Against a consensus forecast of 250,000, the economy gained 528,000 jobs in July 2022. Notably, leisure and hospitality displayed the best performance at a gain of 96,000 jobs. Now, the economy holds more jobs than in early 2020, prior to the pandemic.

Meanwhile, the unemployment rate fell from 3.6% to 3.5%. While unemployment fell below the consensus forecast, it also matched the lowest level since 1969. Additionally, investors and analysts look to average hourly earnings for wage growth indications. Overall, the latest average hourly earnings report showed an impressive 5.2% higher than a year ago, well above the consensus forecast.

ISM Reporting Paints Picture of Shifting Consumer Spending

Aside from the unexpectedly strong job gains, the most recent economic indicators from the Institute of Supply Management (ISM) painted a picture of shifting consumer spending habits. The national services sector index ended several straight months of declines with an unexpected jump to 56.7, well above the consensus forecast of 54.0.

By contrast, the national manufacturing sector index posted an expected drop to 52.8. Still, levels above 50 indicate sector expansion. Consistent with other recent data, these two reports suggest that consumers are purchasing more services and fewer goods.

Investors Anticipate 75-Basis Point Increase in September

Following news of unexpectedly strong job gains and an expanding National Services Sector Index, investors anticipate another large rate hike in September. Last week, most investors priced in a 50-basis point rate hike. Currently, the majority price in a 75-basis point increase while debating next year’s events.

In the present, investors plan for additional rate hikes later this year. Meanwhile, next year should lead to rate cuts as economic growth and inflation decline. Federal Reserve comments suggest that investors price too high a probability of rate cuts next year given the uncertain inflation outlook.

Looking Ahead After Unexpectedly Strong Job Gains

After the unexpectedly strong job gains, investors watch for additional Federal Reserve guidance on the pace of future rate hikes and bond portfolio reduction. Beyond that, they focus on the inflation data.

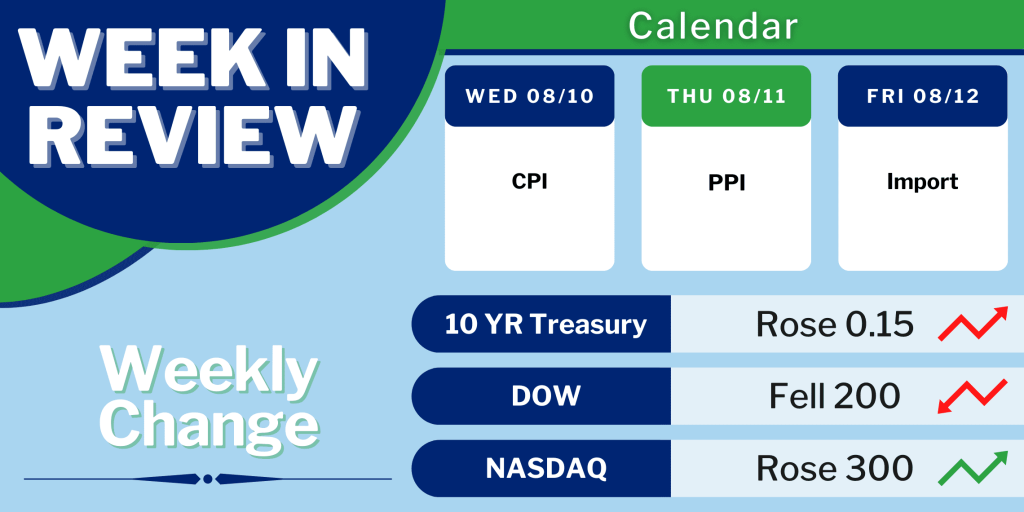

The Consumer Price Index (CPI) releases on Wednesday. Investors and analysts widely follow CPI for price changes covering a broad range of goods and services. Also, the Producer Price Index (PPI) comes out on Thursday of next week. PPI measures price changes for intermediate goods used to make finished products.

With the publication of unexpectedly strong job gains in the Employment report, mortgage rates rose slightly higher by the end of the week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.