Housing momentum continues into 2021 as December shows off a white-hot market. Typically, the end of December exhibits very light trading volume and limited investor reaction to economic news.

In spite of housing trends, this year was no exception. Mortgage rates remained near-record-low levels.

Housing Momentum Continues

Rising coronavirus case counts have slowed economic activity in some areas, such as consumer spending. However, as housing momentum continues, the real estate sector remains white-hot.

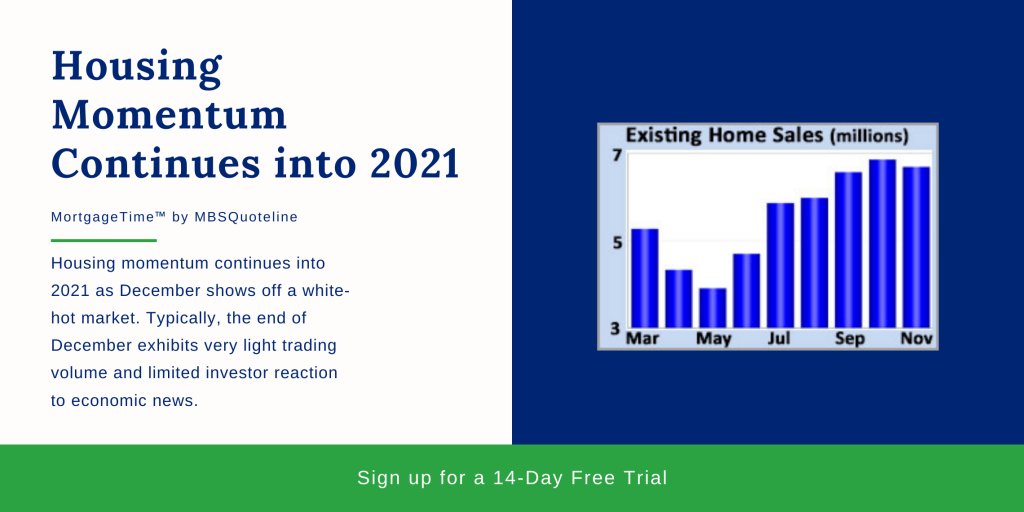

In November, existing home sales were 26% higher than a year ago. This is near the best level since 2006. Also, the median existing-home price was 15% higher than a year ago.

Inventory levels declined 22% from a year ago, remaining the primary sales obstacle. Nationally, the number of homes for sale was at just a 2.3-month supply nationally. This is a record-low and well below the 6.0-month supply, a mark of a healthy balance between buyers and sellers.

Inflation Decline

Reduced economic activity led to a decline in inflation. The pandemic has continually been one of the primary factors responsible for record-low mortgage rates.

In November, the core PCE price index was just 1.4% higher than a year ago. This mirrors last month’s annual rate of increase.

Core PCE is the inflation indicator favored by Fed officials. Their stated goal is to reach a level of 2.0%.

COVID-19 Relief Bill

Last week, Congress passed a $900 billion COVID-19 relief bill. This will provide additional assistance to households, small businesses, and healthcare providers.

The bill also includes an extension of supplemental unemployment benefits of $300 per month and direct payments of $600 to qualifying individuals. Lawmakers continue to discuss whether to increase the amount of these payments.

Looking Ahead After Housing Momentum Continues

Looking ahead, investors will continue watching COVID-19 case counts and vaccine distribution. The Georgia Senate election will take place on January 5. In addition, ISM national manufacturing index is set to be released that day. Meanwhile the ISM national services index will be released on January 7.

The monthly Employment report, January’s most highly anticipated economic data, will be released on January 8. This entails figures on the number of jobs, the unemployment rate, and wage inflation.

Mortgage markets will close early on Thursday. They will also be closed on Friday for New Year’s Day.

Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.