The United States faces strong job gains alongside the Fourth of July weekend. As is common, thin trading conditions helped make the week containing the July Fourth holiday very volatile again.

A decline in global bond yields reflected for U.S. mortgage rates early in the week. However, stronger than expected job gains held the opposite effect on Friday. Thus, mortgage rates ended with little change.

Strong Job Gains Alongside Fourth of July Weekend

Following weak results of under 100,000 in May, the economy added strong job gains alongside the Fourth of July weekend. In fact, the economy boasted a powerful 224,000 jobs in June. As a result, it soared above the consensus forecast of 160,000.

This made the three-month average pace of job growth a solid 171,000. The unemployment rate unexpectedly increased from 3.6% to 3.7%. That said, analysts attribute this to additional people entering the labor force. In conclusion, this represents a sign of labor market strength.

Average Hourly Earnings & Mortgage Rates

While the U.S. realized strong job gains alongside the Fourth of July weekend, average hourly earnings fell short of expectations. Average hourly earnings indicate wage growth. They rose 3.1% higher than a year ago, the same annual rate of increase as last month.

The strong labor market report created a negative impact for mortgage rates in a couple of ways. First, faster economic growth raises the outlook for future inflation. In addition, the data reduced investor expectations for the pace of Fed rate cuts this year.

Trade Talks with China Resume

Aside from the strong job gains alongside wage news, trade talks with China resumed. After a lengthy period with few new developments, the U.S. and China recommenced discussions at the G20 summit over the weekend.

The result led to the two sides agreeing to a truce. The truce mandates a holding off on imposing additional tariffs. Overall, this funds more time to negotiate a long-term deal.

Looking Ahead After Strong Job Gains Alongside Other News

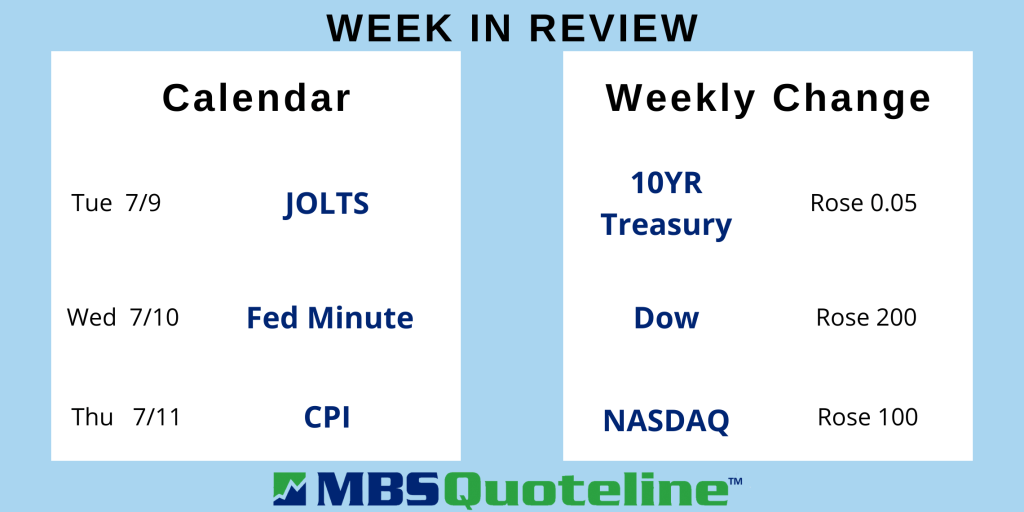

After the strong job gains alongside other news, investors look ahead to the JOLTS report. JOLTS measures job openings and labor turnover rates. The latest report releases on Tuesday. Fed officials value this data to help round out their view of the strength of the labor market.

Meanwhile, the June 19th Fed meeting minutes come out on Wednesday. These detailed minutes provide additional insight into the debate between Fed officials about future monetary policy. The minutes share potential for moving mortgage markets.

Later, the Consumer Price Index (CPI) publishes on Thursday. Investors widely follow the monthly CPI for inflation indication. CPI looks at the price change for goods and services.

Finally, Treasury auctions, speeches by Fed officials, or news about the trade negotiations may influence mortgage rates.

Want to see how the impact of strong job gains alongside recent news on mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.